EXHIBIT 99.1

Published on September 26, 2016

JMP Securities Financial Services

and Real Estate Conference

September 27, 2016

2

Safe Harbor Statement

NOTE:

This presentation contains certain statements that are not historical facts and that constitute “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Statements in this presentation addressing expectations, assumptions, beliefs, projections, estimates, future plans, strategies, and events,

developments that we expect or anticipate will occur in the future, and future operating results or financial condition are forward-looking statements. Forward-looking

statements in this presentation may include, but are not limited to, statements about projected future investment strategies, investment opportunities, future government

or central bank actions and the impact of such actions, financial performance, dividends, leverage ratios, capital raising activities, share issuances and repurchases, the use

or impact of NOL carryforwards, and interest rates. The words “will,” “believe,” “expect,” “forecast,” “anticipate,” “intend,” “estimate,” “assume,” “project,” “plan,”

“continue,” and similar expressions also identify forward-looking statements. These forward-looking statements reflect our current beliefs, assumptions and expectations

based on information currently available to us, and are applicable only as of the date of this presentation. Forward-looking statements are inherently subject to risks,

uncertainties, and other factors, some of which cannot be predicted or quantified and any of which could cause the Company’s actual results and timing of certain events to

differ materially from those projected in or contemplated by these forward-looking statements. Not all of these risks, uncertainties and other factors are known to us. New

risks and uncertainties arise over time, and it is not possible to predict those risks or uncertainties or how they may affect us. The projections, assumptions, expectations or

beliefs upon which the forward-looking statements are based can also change as a result of these risks and uncertainties or other factors. If such a risk, uncertainty, or other

factor materializes in future periods, our business, financial condition, liquidity and results of operations may differ materially from those expressed or implied in our

forward-looking statements.

While it is not possible to identify all factors, some of the factors that may cause actual results to differ from historical results or from any results expressed or implied by

our forward-looking statements, or that may cause our projections, assumptions, expectations or beliefs to change, include the risks and uncertainties referenced in our

Annual Report on Form 10-K for the year ended December 31, 2015 and subsequent filings with the Securities and Exchange Commission, particularly those set forth under

the caption “Risk Factors”.

3

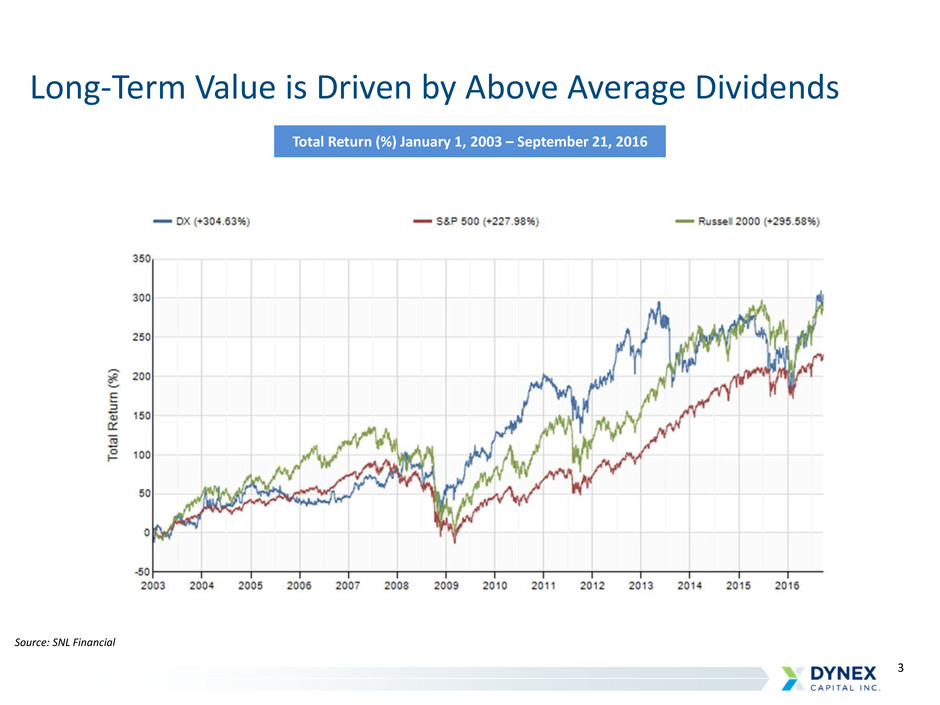

Long-Term Value is Driven by Above Average Dividends

Source: SNL Financial

Total Return (%) January 1, 2003 – September 21, 2016

4

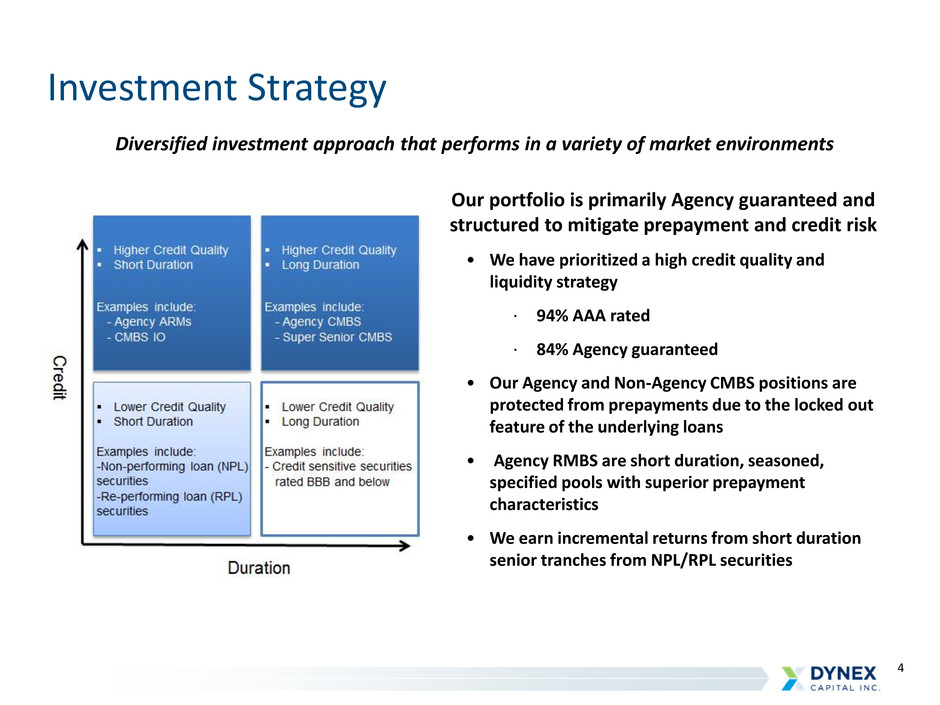

Investment Strategy

Diversified investment approach that performs in a variety of market environments

Our portfolio is primarily Agency guaranteed and

structured to mitigate prepayment and credit risk

• We have prioritized a high credit quality and

liquidity strategy

· 94% AAA rated

· 84% Agency guaranteed

• Our Agency and Non-Agency CMBS positions are

protected from prepayments due to the locked out

feature of the underlying loans

• Agency RMBS are short duration, seasoned,

specified pools with superior prepayment

characteristics

• We earn incremental returns from short duration

senior tranches from NPL/RPL securities

5

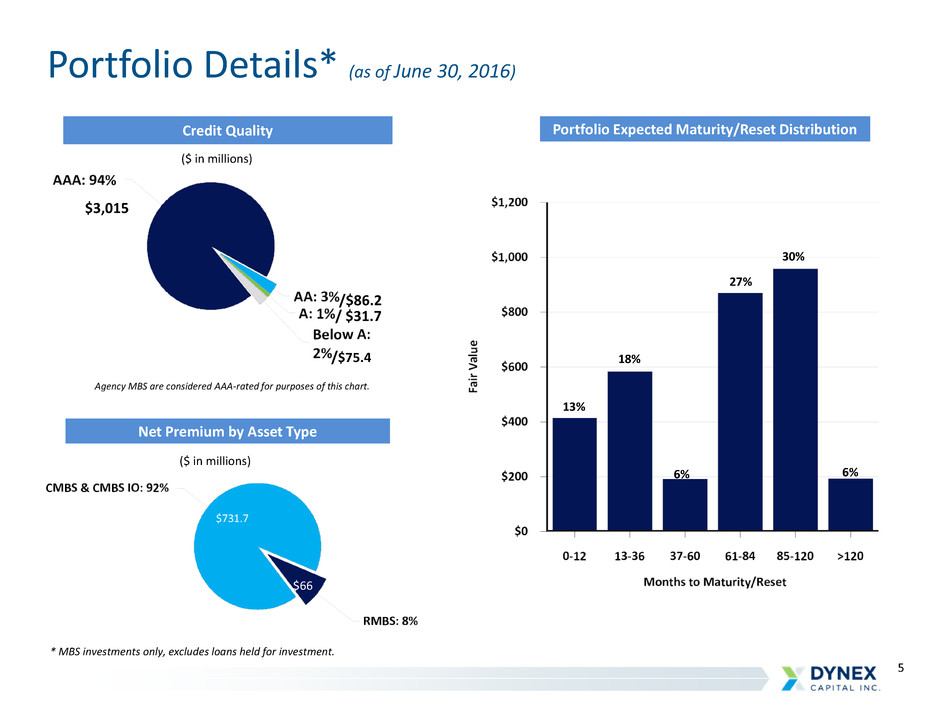

Portfolio Details* (as of June 30, 2016)

Credit Quality Portfolio Expected Maturity/Reset Distribution

Net Premium by Asset Type

* MBS investments only, excludes loans held for investment.

Agency MBS are considered AAA-rated for purposes of this chart.

13%

18%

6%

27%

6%

30%

$731.7

$66

($ in millions)

$3,015

/$86.2

/ $31.7

/$75.4

($ in millions)

6

• Global yields are low or negative, asset returns have declined, and the

probability that yields will remain low and range bound has increased

· Above average dividend yields will be an important driver of future returns

· A flatter yield curve may put downward pressure on net interest spread

• Geopolitical events further reinforce the likelihood of a lower rate environment

• Government policy will continue to drive returns

· Central banks are impacting capital markets, asset prices and credit spreads

· Regulation is redefining risk appetite and liquidity in the markets

• Positive economic news in the U.S. may not be sufficient to allow the Federal

Reserve to raise interest rates due to international factors

· An even flatter yield curve is possible in the U.S.

• Global economic environment, political environment, and markets are all fragile

and as a result we continue to manage our risk posture conservatively

Investment Environment

7

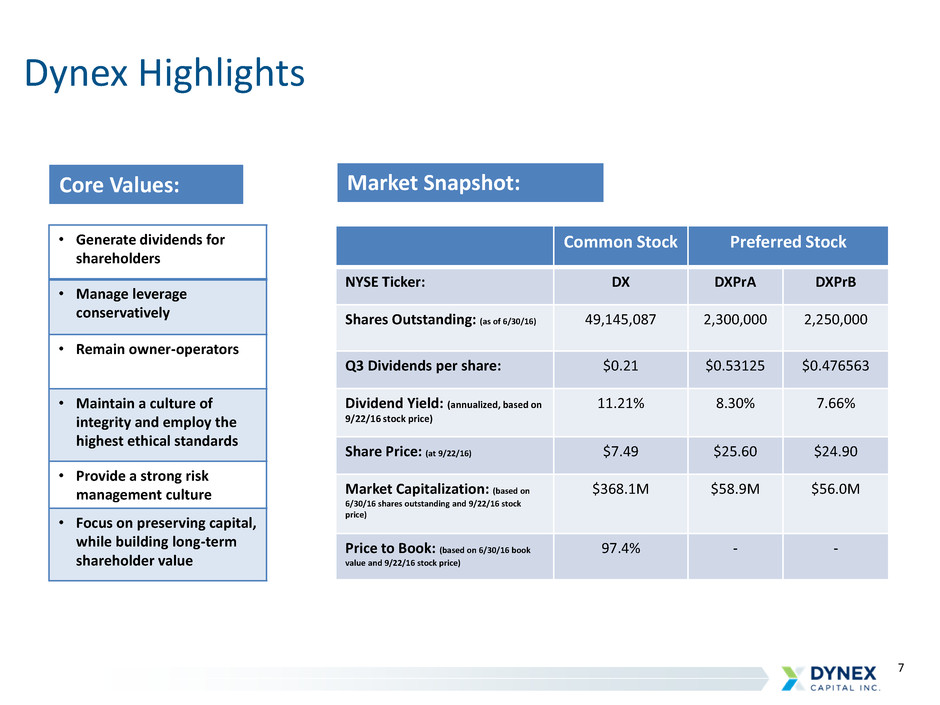

Dynex Highlights

Common Stock Preferred Stock

NYSE Ticker: DX DXPrA DXPrB

Shares Outstanding: (as of 6/30/16) 49,145,087 2,300,000 2,250,000

Q3 Dividends per share: $0.21 $0.53125 $0.476563

Dividend Yield: (annualized, based on

9/22/16 stock price)

11.21% 8.30% 7.66%

Share Price: (at 9/22/16) $7.49 $25.60 $24.90

Market Capitalization: (based on

6/30/16 shares outstanding and 9/22/16 stock

price)

$368.1M $58.9M $56.0M

Price to Book: (based on 6/30/16 book

value and 9/22/16 stock price)

97.4% - -

Core Values:

• Generate dividends for

shareholders

• Manage leverage

conservatively

• Remain owner-operators

• Maintain a culture of

integrity and employ the

highest ethical standards

• Provide a strong risk

management culture

• Focus on preserving capital,

while building long-term

shareholder value

Market Snapshot:

Appendix

9

Second Quarter 2016 Highlights

• Comprehensive income to common shareholders of $0.35 per common share

· $0.21 per common share from core net operating income(1)

· $0.46 from unrealized gains on MBS

· $(0.32) from unrealized losses on derivatives

• Total economic return(2) to common shareholders of 4.8%

• Core net operating income of $0.21 per common share in 2Q16 versus $0.22

per common share in 1Q16

· Smaller investment portfolio in 2Q16

• Net interest spread of 1.94% and adjusted net interest spread(1) of 1.87% in 2Q16

versus 1.97% and 1.76%, respectively in 1Q16

· Adjusted cost of funds(1) decreased 0.12% due to lower periodic interest costs

from hedges

• Overall leverage of 6.1x at June 30, 2016 versus 6.4x at March 31, 2016

(1) Reconciliations for non-GAAP measures are presented in the Appendix.

(2) Computed as dividends of $0.21 per common share plus book value increase of $0.15 per common share dividend by beginning book value per common share of $7.54

10

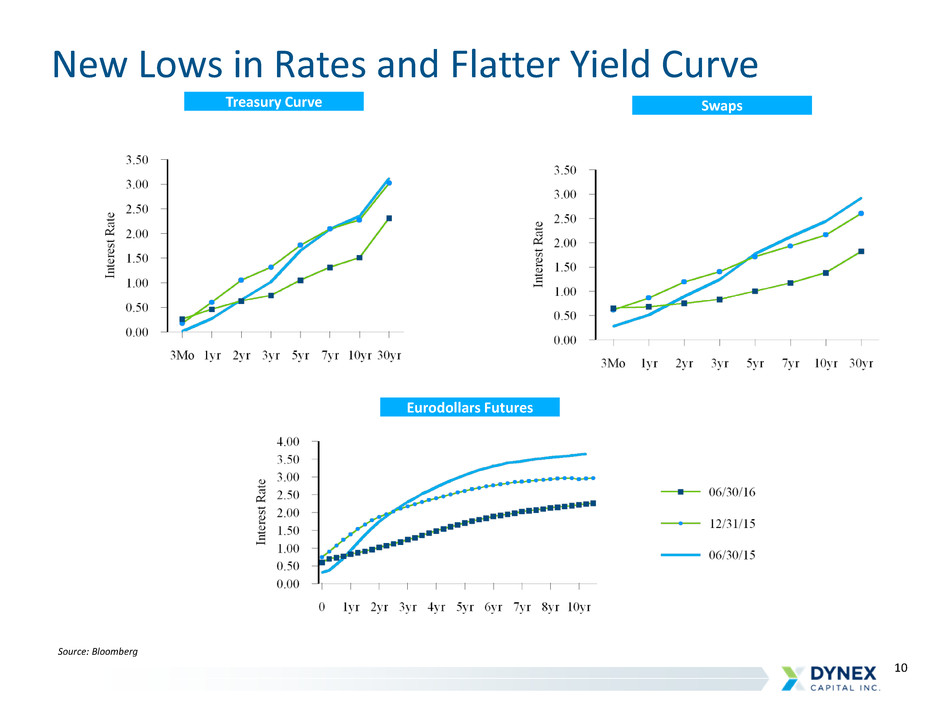

New Lows in Rates and Flatter Yield Curve

Treasury Curve Swaps

Eurodollars Futures

Source: Bloomberg

11

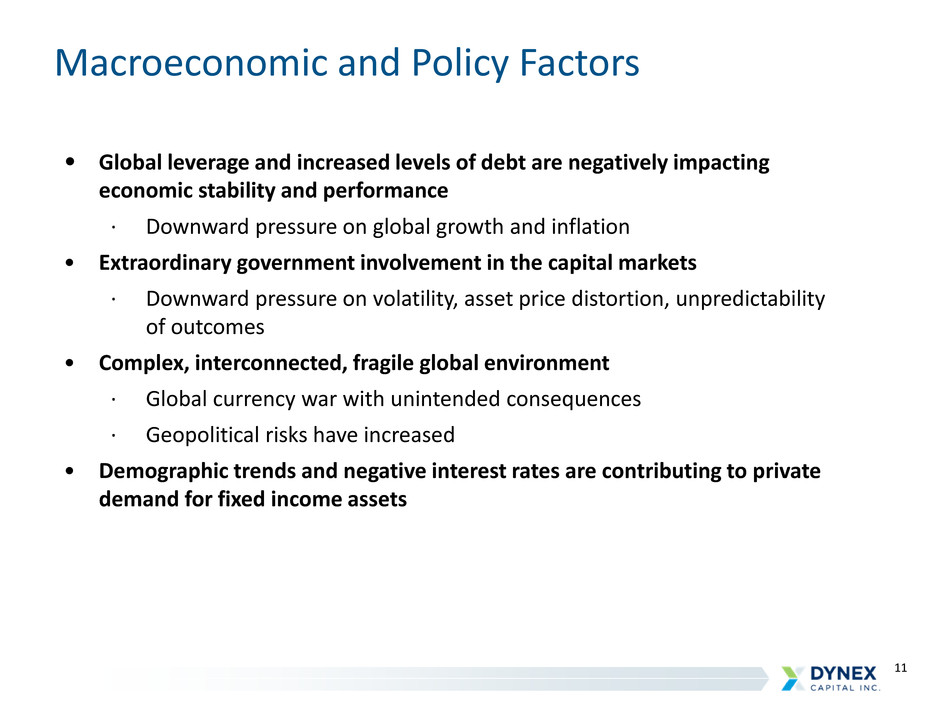

• Global leverage and increased levels of debt are negatively impacting

economic stability and performance

· Downward pressure on global growth and inflation

• Extraordinary government involvement in the capital markets

· Downward pressure on volatility, asset price distortion, unpredictability

of outcomes

• Complex, interconnected, fragile global environment

· Global currency war with unintended consequences

· Geopolitical risks have increased

• Demographic trends and negative interest rates are contributing to private

demand for fixed income assets

Macroeconomic and Policy Factors

12

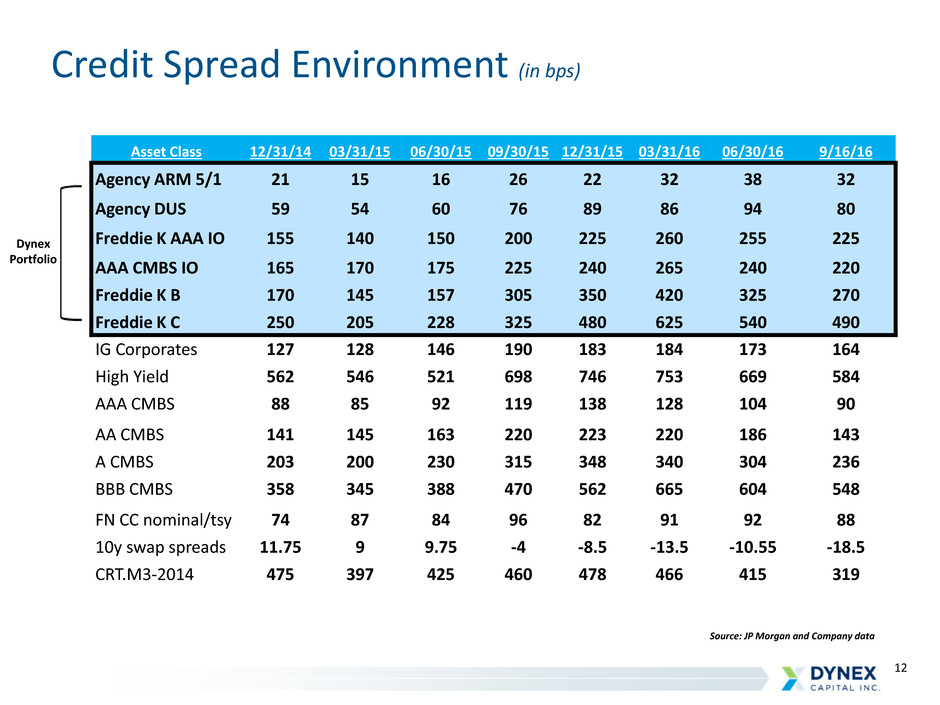

Asset Class 12/31/14 03/31/15 06/30/15 09/30/15 12/31/15 03/31/16 06/30/16 9/16/16

Agency ARM 5/1 21 15 16 26 22 32 38 32

Agency DUS 59 54 60 76 89 86 94 80

Freddie K AAA IO 155 140 150 200 225 260 255 225

AAA CMBS IO 165 170 175 225 240 265 240 220

Freddie K B 170 145 157 305 350 420 325 270

Freddie K C 250 205 228 325 480 625 540 490

IG Corporates 127 128 146 190 183 184 173 164

High Yield 562 546 521 698 746 753 669 584

AAA CMBS 88 85 92 119 138 128 104 90

AA CMBS 141 145 163 220 223 220 186 143

A CMBS 203 200 230 315 348 340 304 236

BBB CMBS 358 345 388 470 562 665 604 548

FN CC nominal/tsy 74 87 84 96 82 91 92 88

10y swap spreads 11.75 9 9.75 -4 -8.5 -13.5 -10.55 -18.5

CRT.M3-2014 475 397 425 460 478 466 415 319

Credit Spread Environment (in bps)

Source: JP Morgan and Company data

Dynex

Portfolio

13

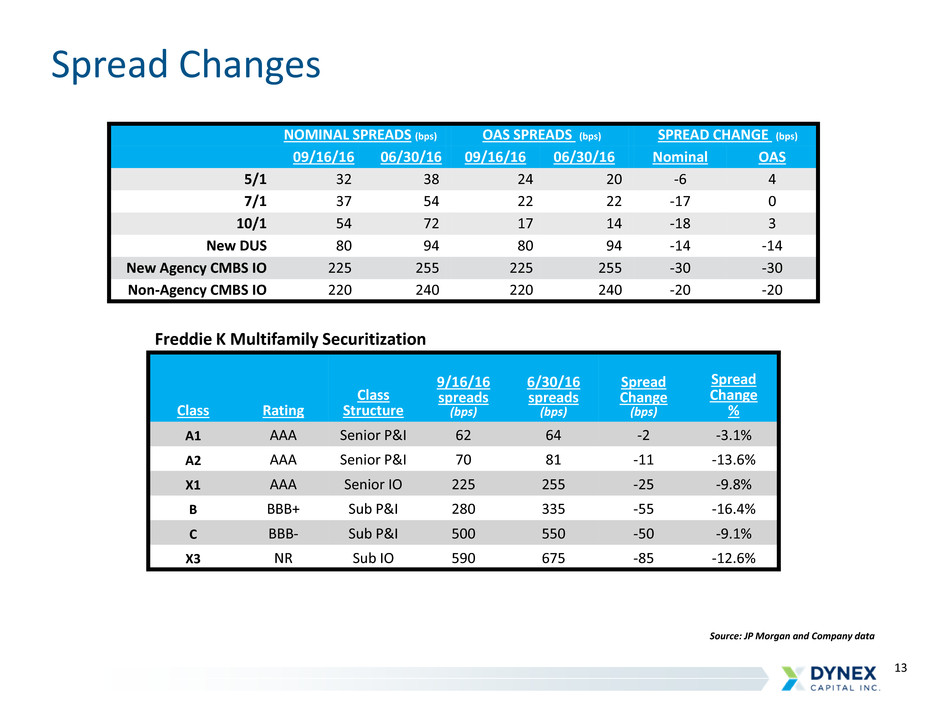

Spread Changes

Source: JP Morgan and Company data

NOMINAL SPREADS (bps) OAS SPREADS (bps) SPREAD CHANGE (bps)

09/16/16 06/30/16 09/16/16 06/30/16 Nominal OAS

5/1 32 38 24 20 -6 4

7/1 37 54 22 22 -17 0

10/1 54 72 17 14 -18 3

New DUS 80 94 80 94 -14 -14

New Agency CMBS IO 225 255 225 255 -30 -30

Non-Agency CMBS IO 220 240 220 240 -20 -20

Class Rating

Class

Structure

9/16/16

spreads

(bps)

6/30/16

spreads

(bps)

Spread

Change

(bps)

Spread

Change

%

A1 AAA Senior P&I 62 64 -2 -3.1%

A2 AAA Senior P&I 70 81 -11 -13.6%

X1 AAA Senior IO 225 255 -25 -9.8%

B BBB+ Sub P&I 280 335 -55 -16.4%

C BBB- Sub P&I 500 550 -50 -9.1%

X3 NR Sub IO 590 675 -85 -12.6%

Freddie K Multifamily Securitization

14

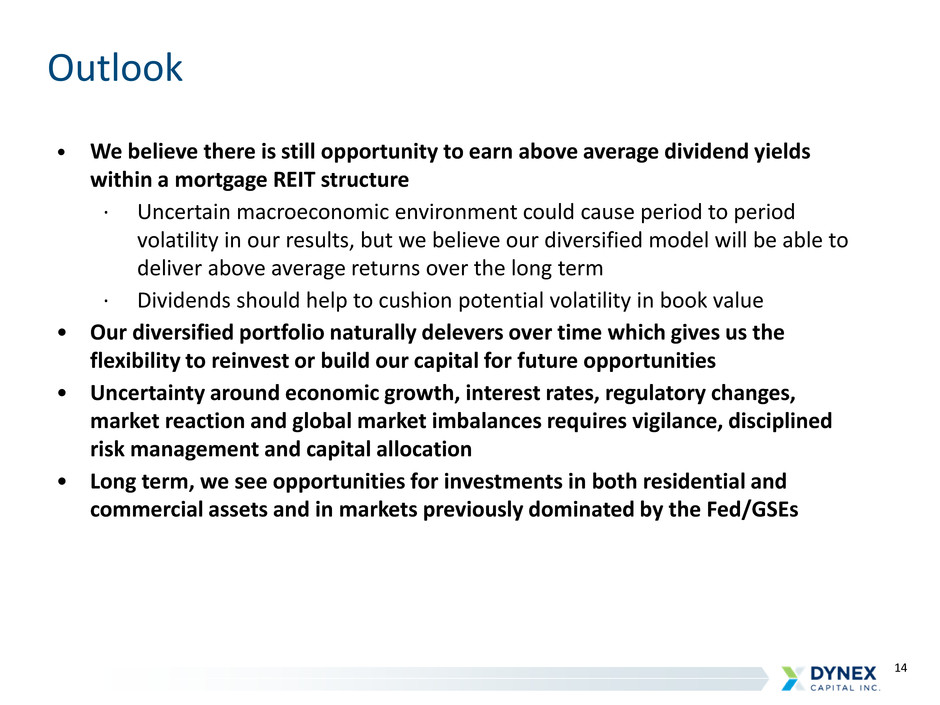

Outlook

• We believe there is still opportunity to earn above average dividend yields

within a mortgage REIT structure

· Uncertain macroeconomic environment could cause period to period

volatility in our results, but we believe our diversified model will be able to

deliver above average returns over the long term

· Dividends should help to cushion potential volatility in book value

• Our diversified portfolio naturally delevers over time which gives us the

flexibility to reinvest or build our capital for future opportunities

• Uncertainty around economic growth, interest rates, regulatory changes,

market reaction and global market imbalances requires vigilance, disciplined

risk management and capital allocation

• Long term, we see opportunities for investments in both residential and

commercial assets and in markets previously dominated by the Fed/GSEs

eve

15

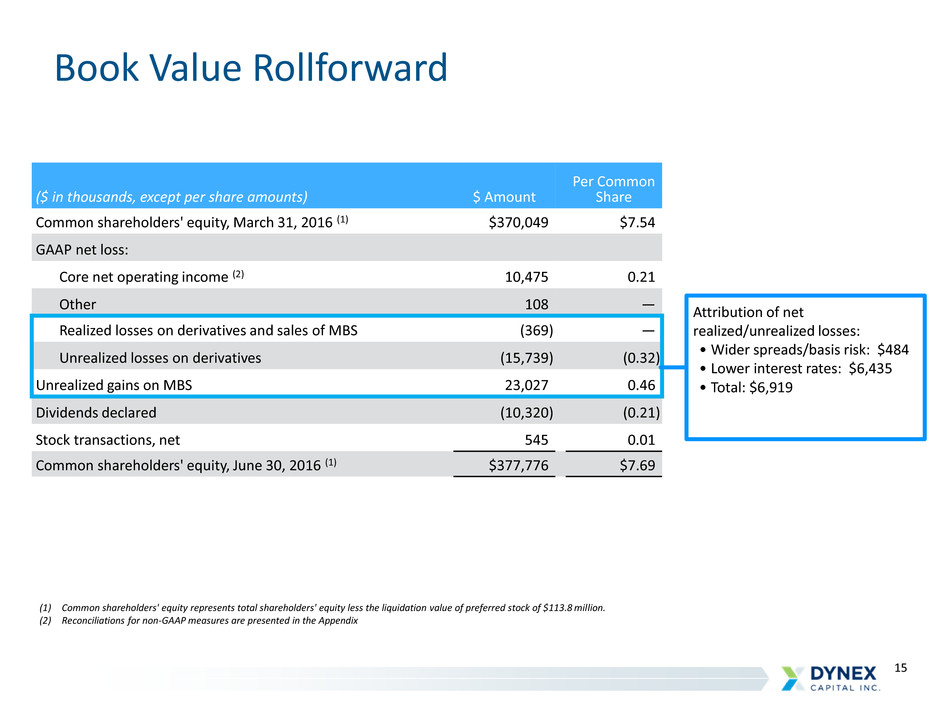

($ in thousands, except per share amounts) $ Amount

Per Common

Share

Common shareholders' equity, March 31, 2016 (1) $370,049 $7.54

GAAP net loss:

Core net operating income (2) 10,475 0.21

Other 108 —

Realized losses on derivatives and sales of MBS (369 ) —

Unrealized losses on derivatives (15,739 ) (0.32 )

Unrealized gains on MBS 23,027 0.46

Dividends declared (10,320 ) (0.21 )

Stock transactions, net 545 0.01

Common shareholders' equity, June 30, 2016 (1) $377,776 $7.69

(1) Common shareholders' equity represents total shareholders' equity less the liquidation value of preferred stock of $113.8 million.

(2) Reconciliations for non-GAAP measures are presented in the Appendix

Book Value Rollforward

Attribution of net

realized/unrealized losses:

• Wider spreads/basis risk: $484

• Lower interest rates: $6,435

• Total: $6,919

16

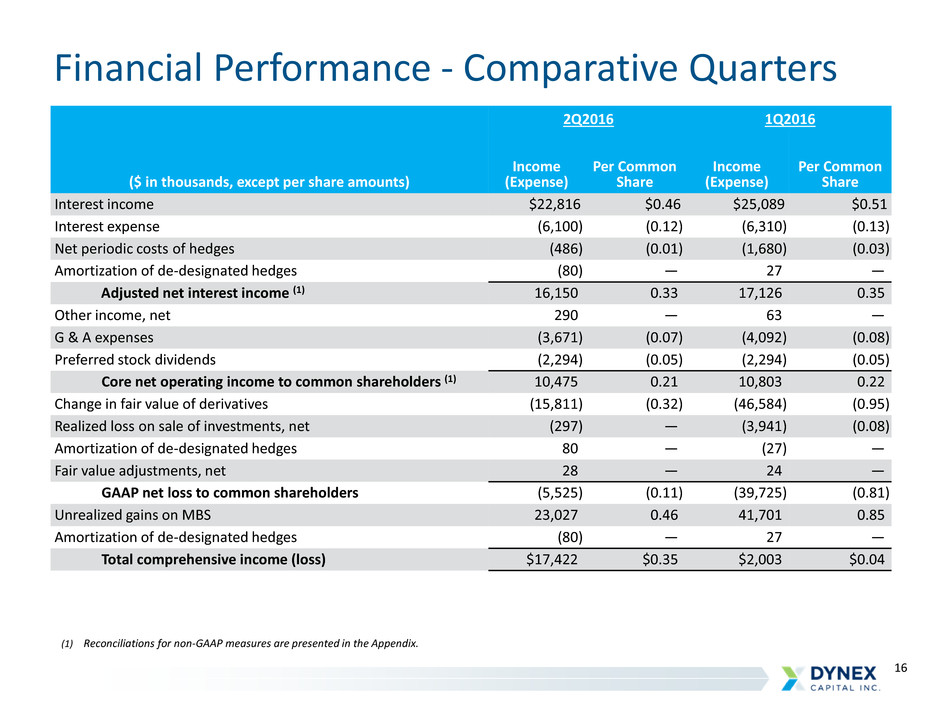

Financial Performance - Comparative Quarters

(1) Reconciliations for non-GAAP measures are presented in the Appendix.

2Q2016 1Q2016

($ in thousands, except per share amounts)

Income

(Expense)

Per Common

Share

Income

(Expense)

Per Common

Share

Interest income $22,816 $0.46 $25,089 $0.51

Interest expense (6,100 ) (0.12 ) (6,310 ) (0.13 )

Net periodic costs of hedges (486 ) (0.01 ) (1,680 ) (0.03 )

Amortization of de-designated hedges (80 ) — 27 —

Adjusted net interest income (1) 16,150 0.33 17,126 0.35

Other income, net 290 — 63 —

G & A expenses (3,671 ) (0.07 ) (4,092 ) (0.08 )

Preferred stock dividends (2,294 ) (0.05 ) (2,294 ) (0.05 )

Core net operating income to common shareholders (1) 10,475 0.21 10,803 0.22

Change in fair value of derivatives (15,811 ) (0.32 ) (46,584 ) (0.95 )

Realized loss on sale of investments, net (297 ) — (3,941 ) (0.08 )

Amortization of de-designated hedges 80 — (27 ) —

Fair value adjustments, net 28 — 24 —

GAAP net loss to common shareholders (5,525 ) (0.11 ) (39,725 ) (0.81 )

Unrealized gains on MBS 23,027 0.46 41,701 0.85

Amortization of de-designated hedges (80 ) — 27 —

Total comprehensive income (loss) $17,422 $0.35 $2,003 $0.04

17

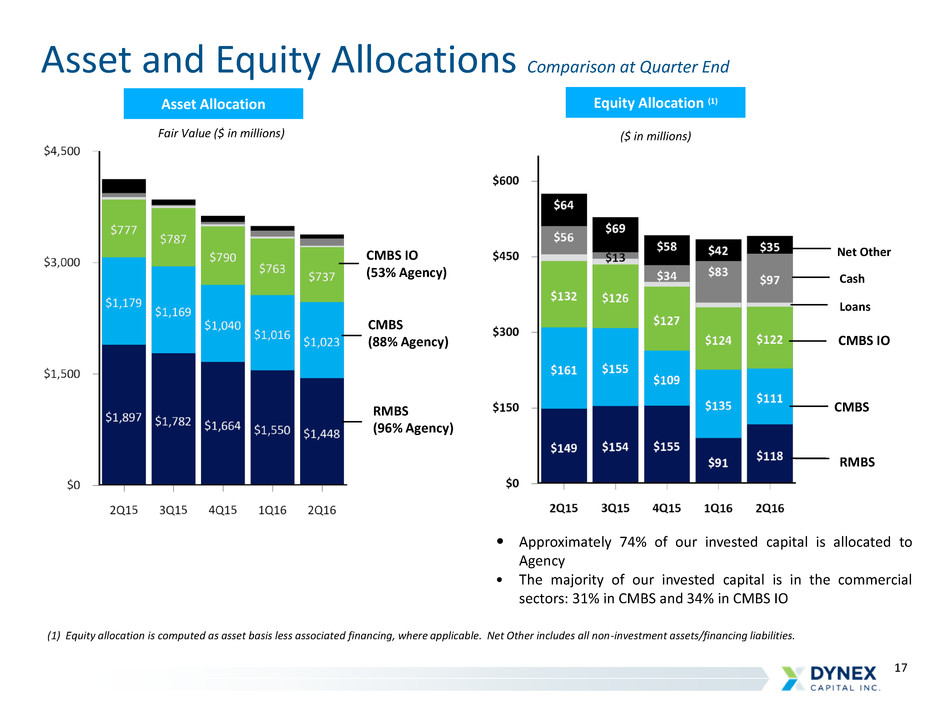

Asset and Equity Allocations Comparison at Quarter End

Asset Allocation Equity Allocation (1)

Fair Value ($ in millions) ($ in millions)

• Approximately 74% of our invested capital is allocated to

Agency

• The majority of our invested capital is in the commercial

sectors: 31% in CMBS and 34% in CMBS IO

(1) Equity allocation is computed as asset basis less associated financing, where applicable. Net Other includes all non-investment assets/financing liabilities.

RMBS

(96% Agency)

CMBS

(88% Agency)

CMBS IO

(53% Agency)

RMBS

CMBS

CMBS IO

Net Other

Cash

Loans

18

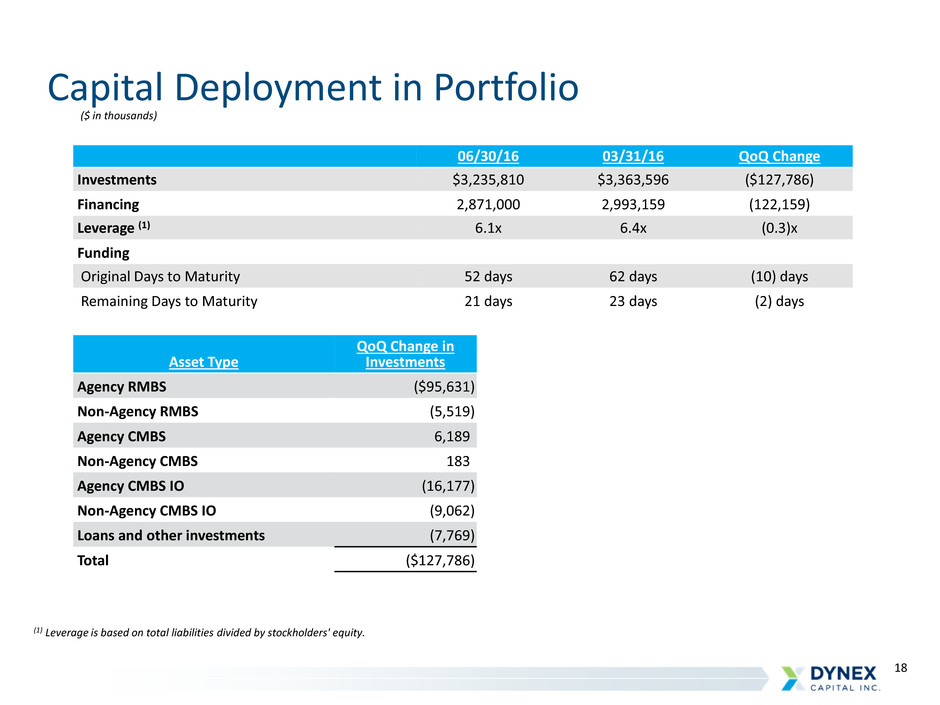

Capital Deployment in Portfolio

06/30/16 03/31/16 QoQ Change

Investments $3,235,810 $3,363,596 ($127,786)

Financing 2,871,000 2,993,159 (122,159)

Leverage (1) 6.1x 6.4x (0.3)x

Funding

Original Days to Maturity 52 days 62 days (10) days

Remaining Days to Maturity 21 days 23 days (2) days

($ in thousands)

Asset Type

QoQ Change in

Investments

Agency RMBS ($95,631 )

Non-Agency RMBS (5,519 )

Agency CMBS 6,189

Non-Agency CMBS 183

Agency CMBS IO (16,177 )

Non-Agency CMBS IO (9,062 )

Loans and other investments (7,769 )

Total ($127,786 )

(1) Leverage is based on total liabilities divided by stockholders' equity.

19

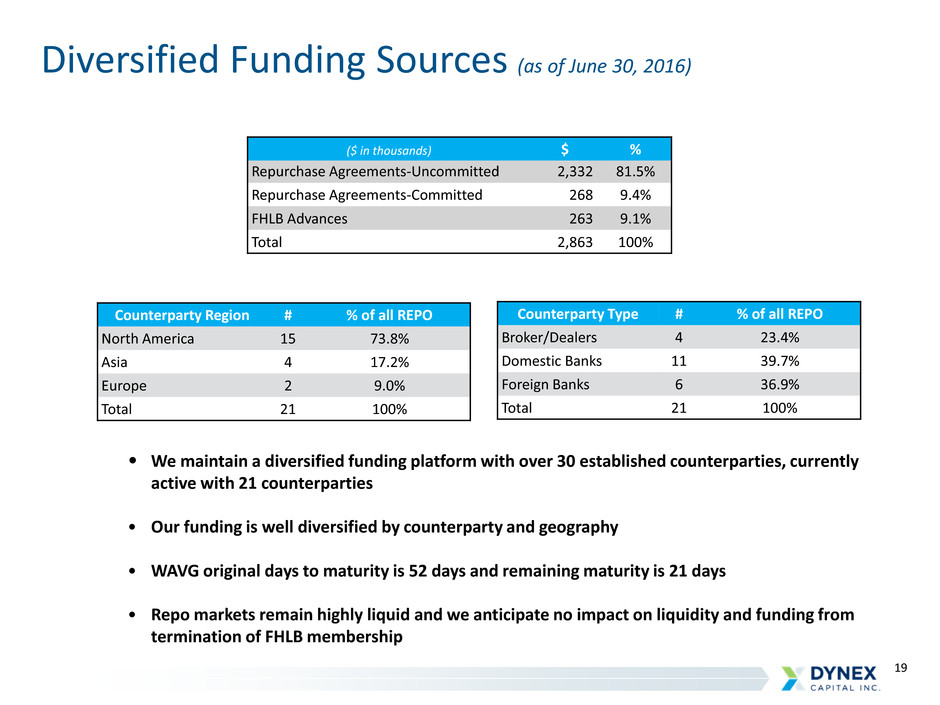

Diversified Funding Sources (as of June 30, 2016)

Counterparty Region # % of all REPO

North America 15 73.8%

Asia 4 17.2%

Europe 2 9.0%

Total 21 100%

Counterparty Type # % of all REPO

Broker/Dealers 4 23.4%

Domestic Banks 11 39.7%

Foreign Banks 6 36.9%

Total 21 100%

• We maintain a diversified funding platform with over 30 established counterparties, currently

active with 21 counterparties

• Our funding is well diversified by counterparty and geography

• WAVG original days to maturity is 52 days and remaining maturity is 21 days

• Repo markets remain highly liquid and we anticipate no impact on liquidity and funding from

termination of FHLB membership

($ in thousands) $ %

Repurchase Agreements-Uncommitted 2,332 81.5%

Repurchase Agreements-Committed 268 9.4%

FHLB Advances 263 9.1%

Total 2,863 100%

20

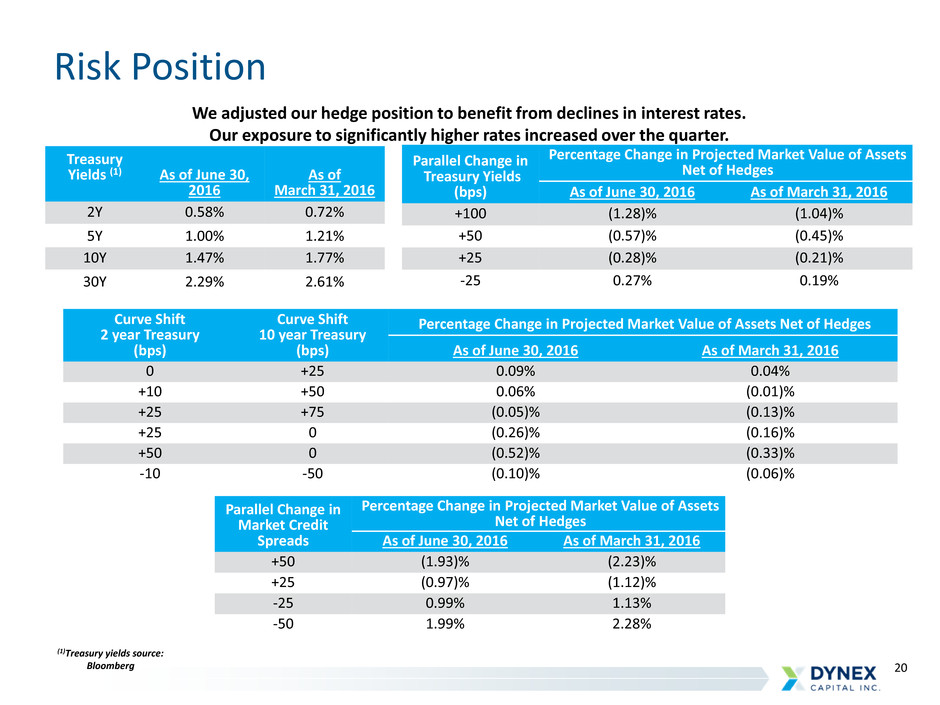

Risk Position

Treasury

Yields (1)

As of June 30,

2016

As of

March 31, 2016

2Y 0.58% 0.72%

5Y 1.00% 1.21%

10Y 1.47% 1.77%

30Y 2.29% 2.61%

Parallel Change in

Treasury Yields

(bps)

Percentage Change in Projected Market Value of Assets

Net of Hedges

As of June 30, 2016 As of March 31, 2016

+100 (1.28)% (1.04)%

+50 (0.57)% (0.45)%

+25 (0.28)% (0.21)%

-25 0.27% 0.19%

Curve Shift

2 year Treasury

(bps)

Curve Shift

10 year Treasury

(bps)

Percentage Change in Projected Market Value of Assets Net of Hedges

As of June 30, 2016 As of March 31, 2016

0 +25 0.09% 0.04%

+10 +50 0.06% (0.01)%

+25 +75 (0.05)% (0.13)%

+25 0 (0.26)% (0.16)%

+50 0 (0.52)% (0.33)%

-10 -50 (0.10)% (0.06)%

Parallel Change in

Market Credit

Spreads

Percentage Change in Projected Market Value of Assets

Net of Hedges

As of June 30, 2016 As of March 31, 2016

+50 (1.93)% (2.23)%

+25 (0.97)% (1.12)%

-25 0.99% 1.13%

-50 1.99% 2.28%

(1)Treasury yields source:

Bloomberg

We adjusted our hedge position to benefit from declines in interest rates.

Our exposure to significantly higher rates increased over the quarter.

21

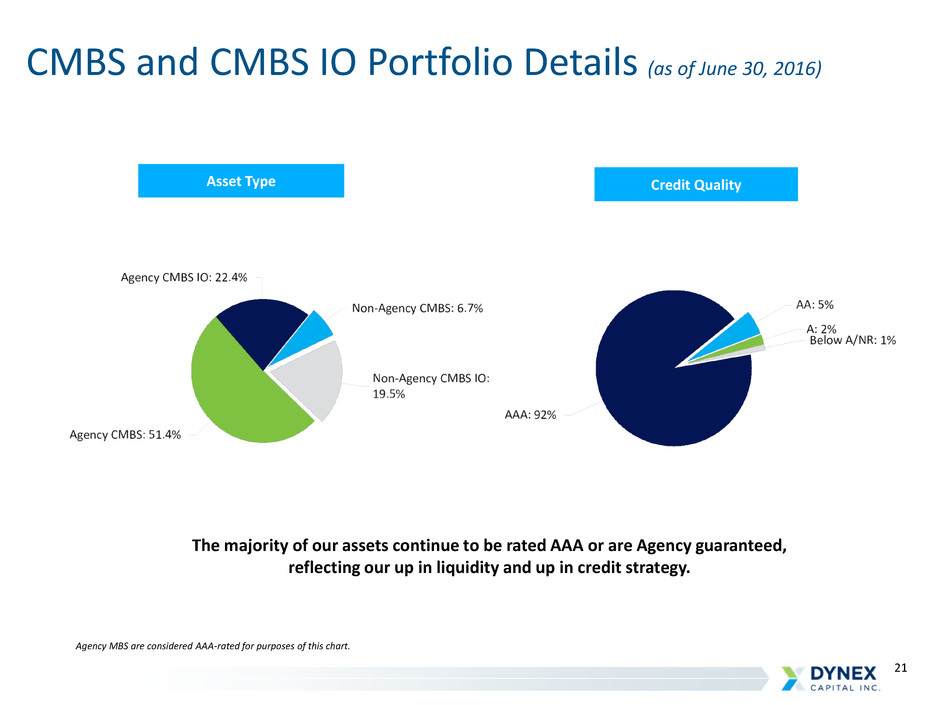

CMBS and CMBS IO Portfolio Details (as of June 30, 2016)

Asset Type Credit Quality

Agency MBS are considered AAA-rated for purposes of this chart.

The majority of our assets continue to be rated AAA or are Agency guaranteed,

reflecting our up in liquidity and up in credit strategy.

22

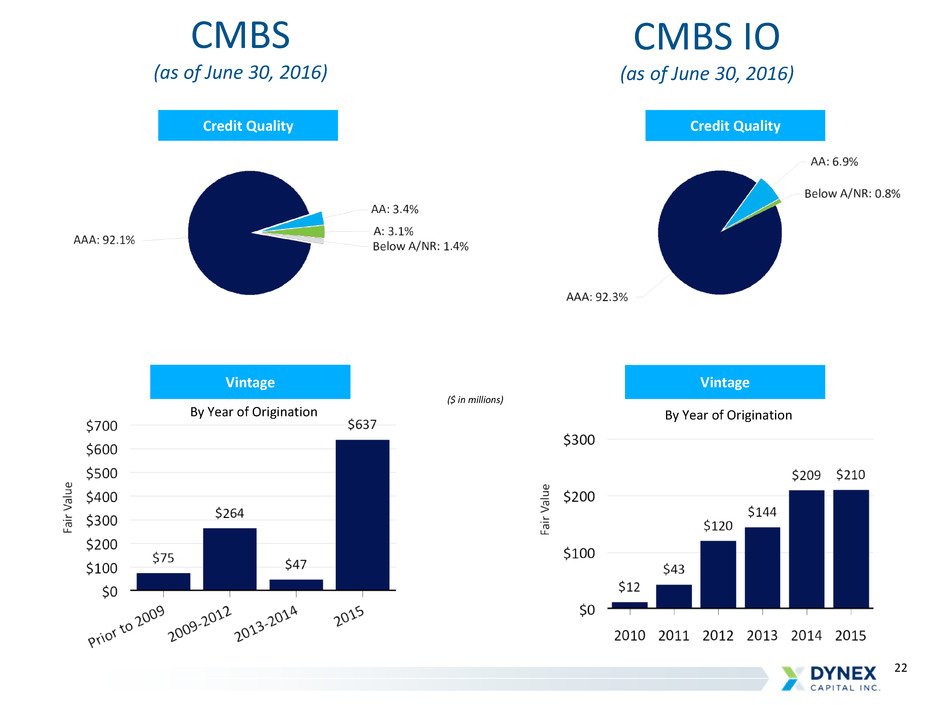

CMBS

(as of June 30, 2016)

Vintage

CMBS IO

(as of June 30, 2016)

Vintage

By Year of Origination By Year of Origination

($ in millions)

Credit Quality Credit Quality

23

($ in millions)

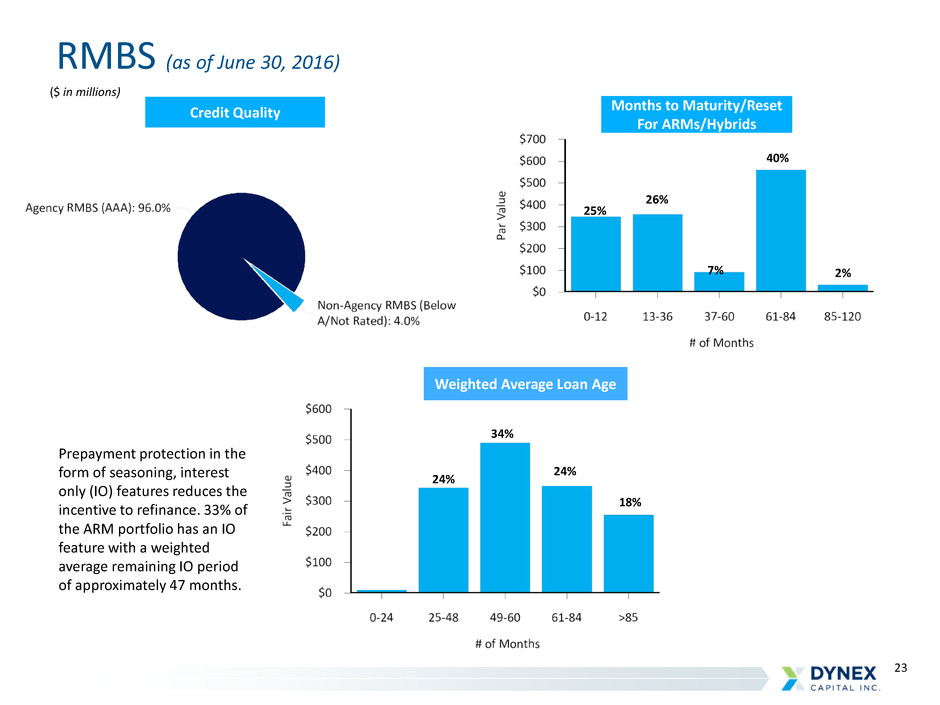

RMBS (as of June 30, 2016)

Credit Quality Months to Maturity/Reset

For ARMs/Hybrids

Weighted Average Loan Age

24%

34%

24%

18%

25% 26%

7%

40%

2%

Prepayment protection in the

form of seasoning, interest

only (IO) features reduces the

incentive to refinance. 33% of

the ARM portfolio has an IO

feature with a weighted

average remaining IO period

of approximately 47 months.

24

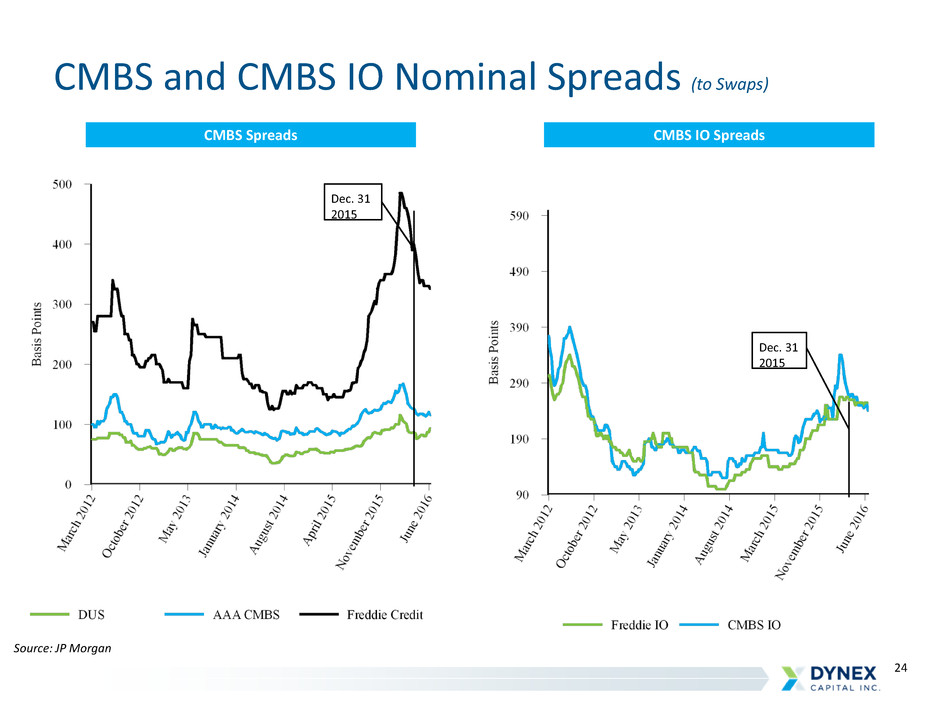

CMBS and CMBS IO Nominal Spreads (to Swaps)

Source: JP Morgan

CMBS IO Spreads CMBS Spreads

Dec. 31

2015

Dec. 31

2015

25

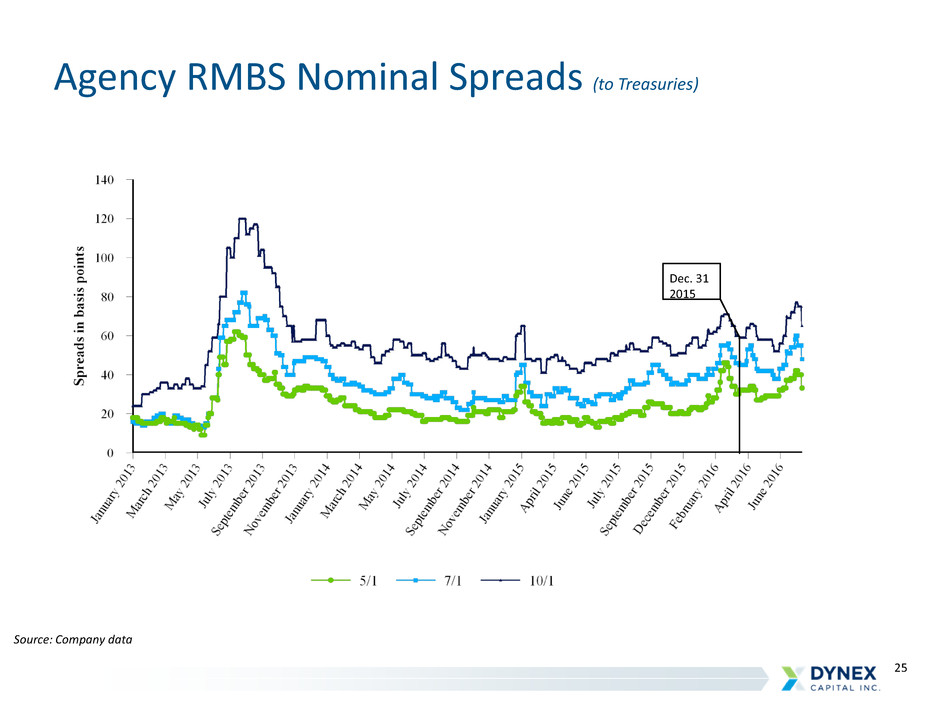

Agency RMBS Nominal Spreads (to Treasuries)

Source: Company data

Dec. 31

2015

26

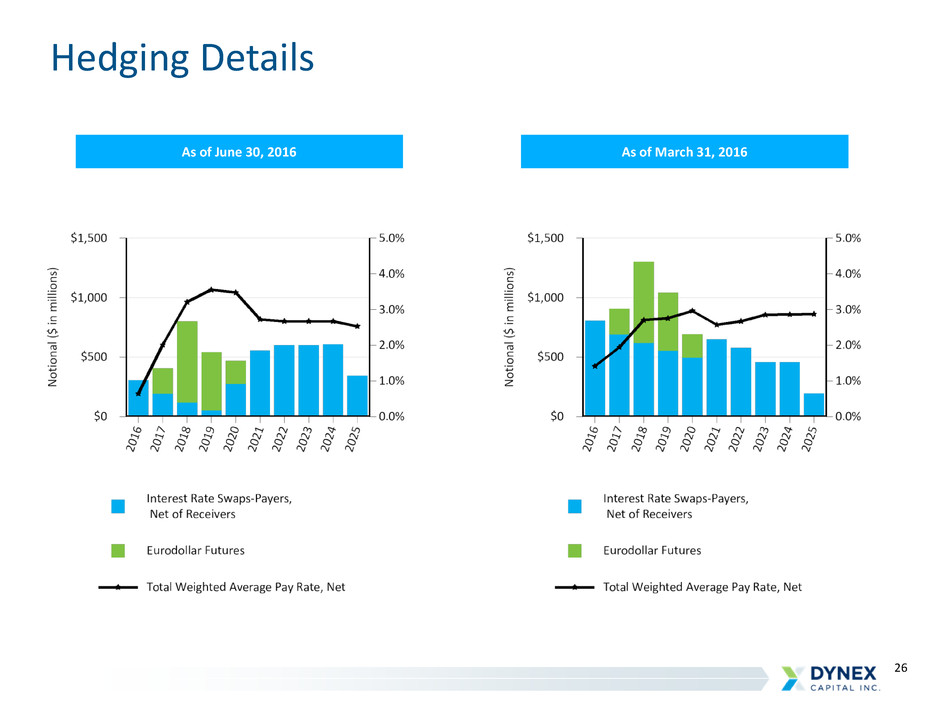

Hedging Details

As of June 30, 2016 As of March 31, 2016

27

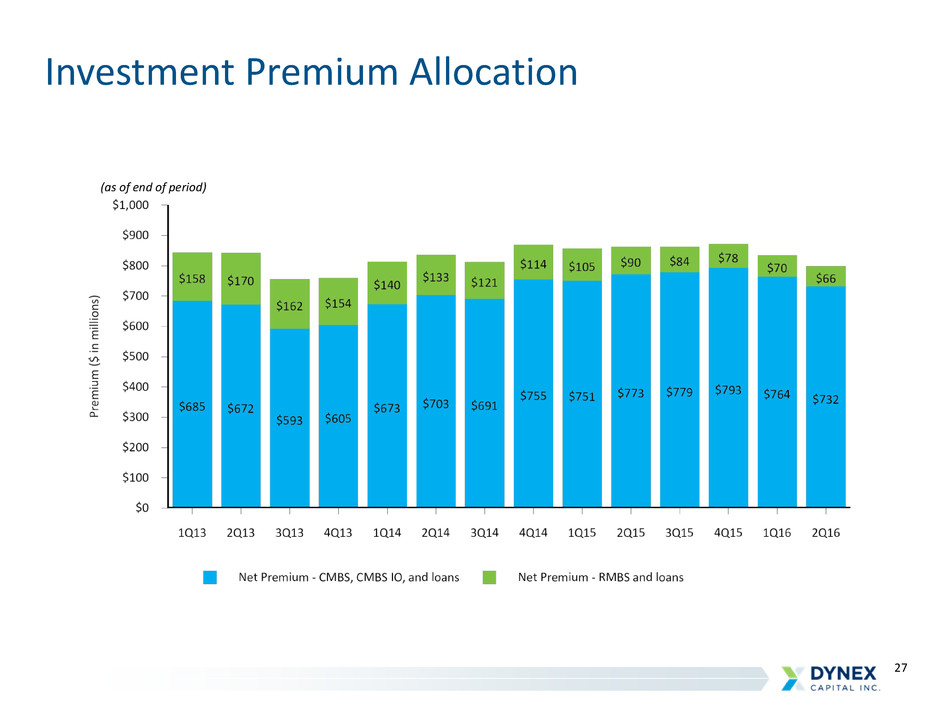

Investment Premium Allocation

(as of end of period)

28

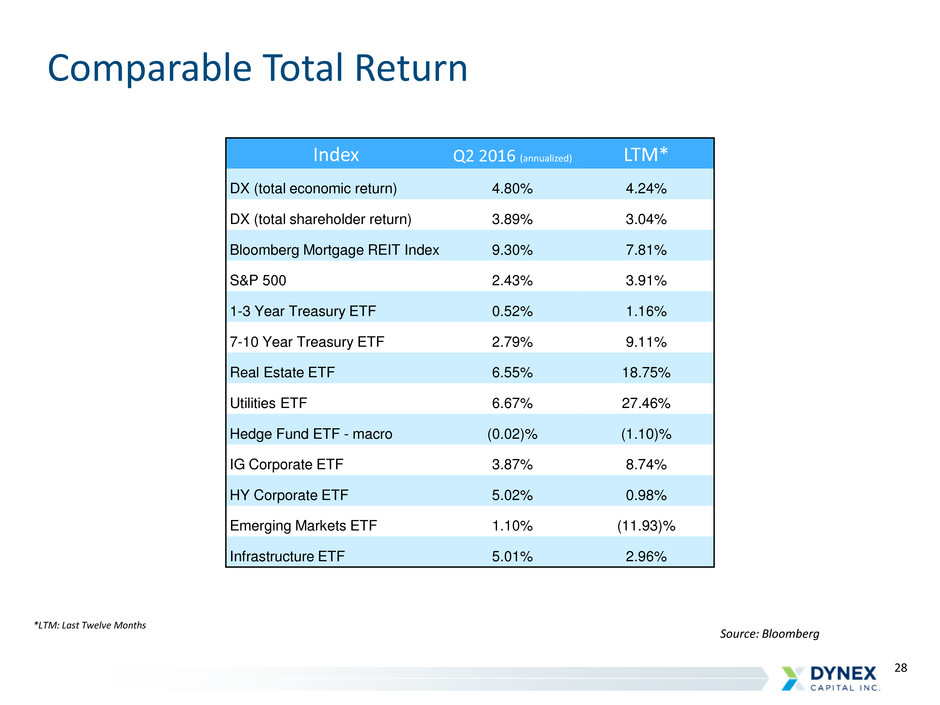

Comparable Total Return

Index Q2 2016 (annualized) LTM*

DX (total economic return) 4.80% 4.24%

DX (total shareholder return) 3.89% 3.04%

Bloomberg Mortgage REIT Index 9.30% 7.81%

S&P 500 2.43% 3.91%

1-3 Year Treasury ETF 0.52% 1.16%

7-10 Year Treasury ETF 2.79% 9.11%

Real Estate ETF 6.55% 18.75%

Utilities ETF 6.67% 27.46%

Hedge Fund ETF - macro (0.02)% (1.10)%

IG Corporate ETF 3.87% 8.74%

HY Corporate ETF 5.02% 0.98%

Emerging Markets ETF 1.10% (11.93)%

Infrastructure ETF 5.01% 2.96%

*LTM: Last Twelve Months

Source: Bloomberg

29

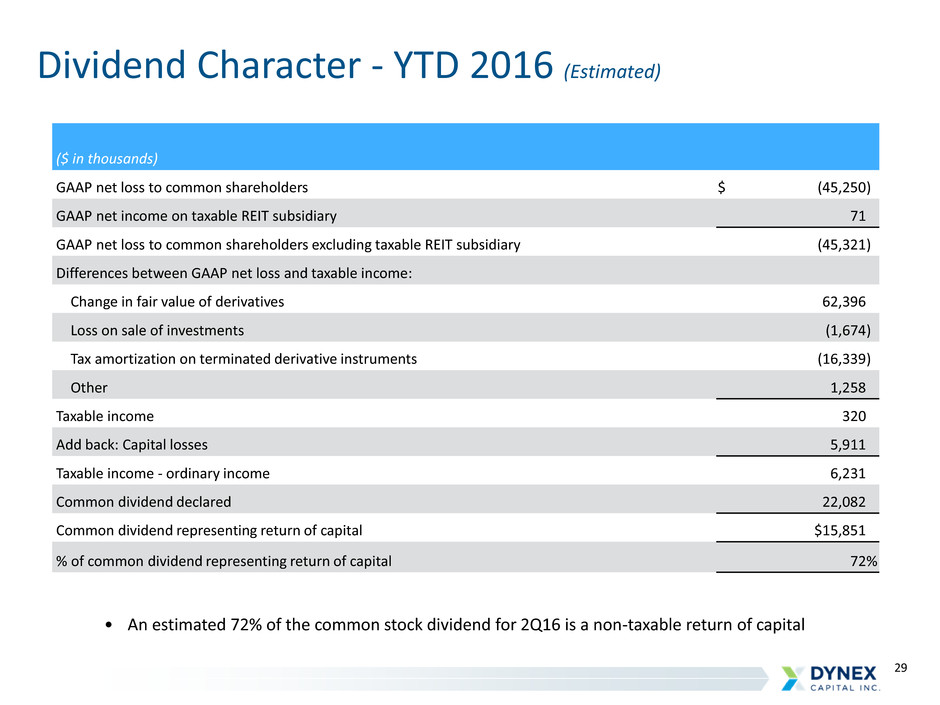

Dividend Character - YTD 2016 (Estimated)

($ in thousands)

GAAP net loss to common shareholders $ (45,250 )

GAAP net income on taxable REIT subsidiary 71

GAAP net loss to common shareholders excluding taxable REIT subsidiary (45,321 )

Differences between GAAP net loss and taxable income:

Change in fair value of derivatives 62,396

Loss on sale of investments (1,674 )

Tax amortization on terminated derivative instruments (16,339 )

Other 1,258

Taxable income 320

Add back: Capital losses 5,911

Taxable income - ordinary income 6,231

Common dividend declared 22,082

Common dividend representing return of capital $15,851

% of common dividend representing return of capital 72 %

• An estimated 72% of the common stock dividend for 2Q16 is a non-taxable return of capital

30

Reconciliation of GAAP Measures to Non-GAAP Measures

($ in thousands except per share data)

Quarter Ended

06/30/16 3/31/16 12/31/15 9/30/15 6/30/15

Net (loss) income to common shareholders ($5,525 ) ($39,725 ) $30,237 ($39,271 ) $28,168

Adjustments:

Amortization of de-designated cash flow hedges (1) (80 ) 27 727 857 857

Change in fair value on derivatives instruments, net 15,811 46,584 (19,177 ) 50,997 (18,883 )

Loss (gain) on sale of investments, net 297 3,941 908 (113 ) 1,491

Fair value adjustments, net (28 ) (24 ) 6 (16 ) (20 )

Core net operating income to common shareholders $10,475 $10,803 $12,701 $12,454 $11,613

Core net operating income per common share $0.21 $0.22 $0.25 $0.24 $0.21

(1) Amount recorded as a portion of "interest expense" in accordance with GAAP related to the amortization of the balance remaining in accumulated other

comprehensive loss as of June 30, 2013 as a result of the Company's discontinuation of cash flow hedge accounting.

Quarter Ended

06/30/16 3/31/16 12/31/15 9/30/15 6/30/15

Interest income $ 22,816 $ 25,089 $ 25,522 $ 26,096 $ 24,527

Adjusted interest expense (1) 6,666 7,963 6,429 6,754 6,478

Adjusted net interest income (1) 16,150 17,126 19,093 19,342 18,049

Other income, net 290 63 180 (215 ) 612

General & administrative expenses (3,671 ) (4,092 ) (4,278 ) (4,379 ) (4,754 )

Preferred stock dividends (2,294 ) (2,294 ) (2,294 ) (2,294 ) (2,294 )

Core net operating income to common

shareholders $ 10,475 $ 10,803 $ 12,701 $ 12,454 $ 11,613

(1) Reconciled on next page.

31

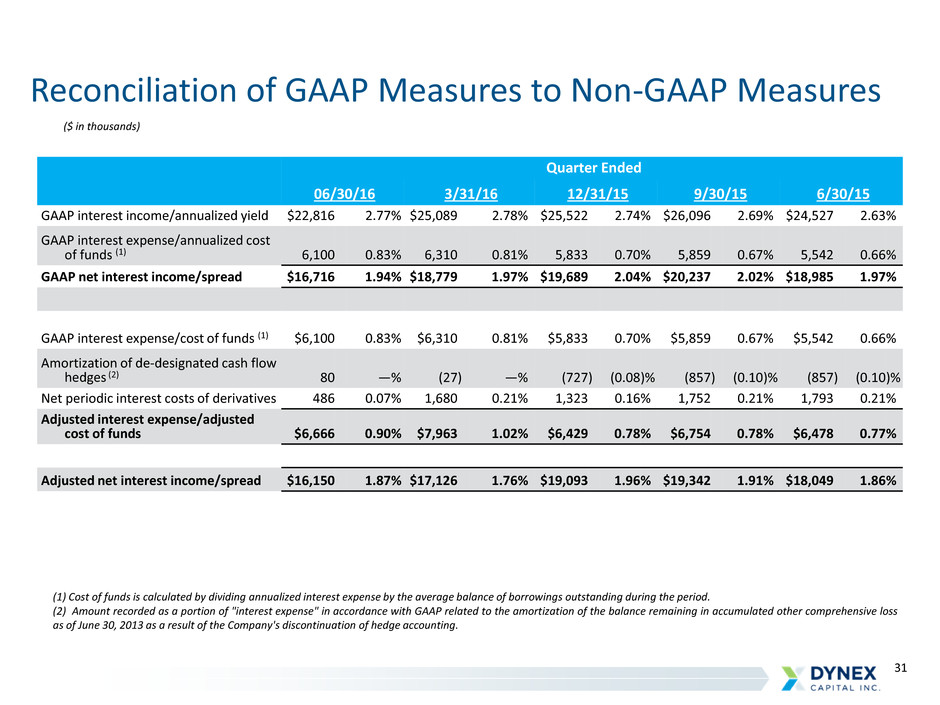

Reconciliation of GAAP Measures to Non-GAAP Measures

Quarter Ended

06/30/16 3/31/16 12/31/15 9/30/15 6/30/15

GAAP interest income/annualized yield $22,816 2.77 % $25,089 2.78 % $25,522 2.74 % $26,096 2.69 % $24,527 2.63 %

GAAP interest expense/annualized cost

of funds (1) 6,100 0.83 % 6,310 0.81 % 5,833 0.70 % 5,859 0.67 % 5,542 0.66 %

GAAP net interest income/spread $16,716 1.94 % $18,779 1.97 % $19,689 2.04 % $20,237 2.02 % $18,985 1.97 %

GAAP interest expense/cost of funds (1) $6,100 0.83 % $6,310 0.81 % $5,833 0.70 % $5,859 0.67 % $5,542 0.66 %

Amortization of de-designated cash flow

hedges (2) 80 — % (27 ) — % (727 ) (0.08 )% (857 ) (0.10 )% (857 ) (0.10 )%

Net periodic interest costs of derivatives 486 0.07 % 1,680 0.21 % 1,323 0.16 % 1,752 0.21 % 1,793 0.21 %

Adjusted interest expense/adjusted

cost of funds $6,666 0.90 % $7,963 1.02 % $6,429 0.78 % $6,754 0.78 % $6,478 0.77 %

Adjusted net interest income/spread $16,150 1.87 % $17,126 1.76 % $19,093 1.96 % $19,342 1.91 % $18,049 1.86 %

(1) Cost of funds is calculated by dividing annualized interest expense by the average balance of borrowings outstanding during the period.

(2) Amount recorded as a portion of "interest expense" in accordance with GAAP related to the amortization of the balance remaining in accumulated other comprehensive loss

as of June 30, 2013 as a result of the Company's discontinuation of hedge accounting.

($ in thousands)

32

Risk Management

Key Risk Dynex Risk Mitigating Strategy

Interest Rate/Extension Risk

Duration target of 0.5 to 1.5 years

Derivatives to economically hedge interest rate risk

Invest in credit assets that should increase in value as rates rise

Short duration assets and more predictable cash flows

Prepayment Risk

CMBS investments with prepayment call protection

RMBS specified pools with diversity of prepayment risk

Credit Risk

94% of MBS are AAA-rated* as of June 30, 2016

Current credit risk is multifamily focused

Spread Risk Portfolio construction and long-term portfolio strategy

Liquidity Risk

High quality investment portfolio

Diversified repurchase agreement counterparties and low leverage

Unencumbered liquidity to meet expected risk events

*Agency MBS are considered AAA-rated as of the date presented.

33

MREIT Glossary of Terms

Commercial Mortgage-Backed Securities (CMBS) are a type of mortgage-backed security that is secured by the

loan on a commercial property.

Credit Risk is the risk of loss of principal stemming from a borrower’s failure to repay a loan.

Curve Twist Terms:

Bull Flattener: If the yield curve is exhibiting bull flattener behavior, the spread between the long-term

rate and the short-term rate is getting smaller because long-term rates are decreasing as short-term

rates are increasing. This could occur as more investors choose long-term bonds relative to short-term

bonds, which drives long-term bond prices up and reduces yields.

Bear Flattener: A yield-rate environment in which short-term interest rates are increasing at a faster rate

than long-term interest rates. This causes the yield curve to flatten as short-term and long-term rates

start to converge.

Bear Steepener: Widening of the yield curve caused by long-term rates increasing at a faster rate than

short-term rates. This causes a larger spread between the two rates as the long-term rate moves

further away from the short-term rate.

Bull Steepener: A change in the yield curve caused by short-term rates falling faster than long-term rates,

resulting in a higher spread between the two rates.

Duration is a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates.

Duration is expressed as a number of years.

Interest Only Securities (IOs) are the interest only strips of mortgage, Treasury, or bond payments, which are

separated and sold individually from the principal portions.

34

MREIT Glossary of Terms

Interest Rate Risk is the risk that an investment’s value will change due to a change in the absolute level of

interest rates, in the spread between two rates, in the shape of the yield curve or in any other interest rate

relationship.

Leverage is the use of borrowed money to finance assets.

Prepayment Risk is the risk associated with the early unscheduled return of principal.

Repurchase Agreements are a short-term borrowing that uses loans or securities as collateral. The lender

advances only a percentage of the value of the asset (the advance rate). The inverse of the advance rate is the

equity contribution of the borrower (the haircut).

Residential Mortgage-Backed Securities (RMBS) are a type of mortgage-backed debt obligation whose cash

flows come from residential debt, such as mortgages, home-equity loans and subprime mortgages.

Spread Risk is the uncertainty in pricing resulting from the expansion and contraction of the risk premium over

the benchmark or the risk of how the spread of a security will react over the benchmarked security. treasury

curve.