EXHIBIT 99.1

Published on December 13, 2011

Dynex

Capital, Inc. Investor Presentation

December 13, 2011

Exhibit 99.1 |

2

2

Safe Harbor Statement

NOTE:

This

presentation

contains

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation Reform Act of 1995, including statements about projected future investment

strategies and leverage ratios, financial performance, the projected impact of NOL

carryforwards, future dividends paid to

shareholders,

and

future

investment

opportunities

and

capital

raising

activities.

The

words

will,

believe,

expect,

forecast,

anticipate,

intend,

estimate,

assume,

project,

plan,

continue,

and

similar

expressions

also

identify

forward-looking

statements

that

are

inherently

subject

to

risks

and

uncertainties,

some

of

which

cannot

be

predicted

or

quantified.

Although

these

forward-

looking statements reflect our current beliefs, assumptions and expectations based on

information currently available to us, the Companys actual results and timing of

certain events could differ materially from those projected in or contemplated by these

statements. Our forward-looking statements are subject to the following principal

risks and uncertainties: our ability to find suitable reinvestment opportunities;

changes in economic conditions; changes in interest rates and interest rate spreads,

including the repricing of interest-earnings assets and interest-bearing liabilities;

our investment portfolio performance particularly as it relates to cash flow,

prepayment rates and credit performance; adverse reactions in financial markets related

to the budget deficit or national debt of the United States government; potential or

actual default by the United States government on Treasury securities; and potential or

actual downgrades to the sovereign credit rating of the United States or the credit

ratings of GSEs;

the cost and availability of financing; the cost and availability of new equity capital;

changes in our use of leverage; the quality of performance of third-party service

providers of our loans and loans underlying our securities; the level of defaults

by borrowers on loans we have securitized; changes in our industry; increased

competition; changes in government regulations affecting our business; government

initiatives to support the U.S financial system and U.S. housing and real estate markets;

GSE reform or other government policies and actions; and an ownership shift under Section 382

of the Internal Revenue Code that impacts the use of our tax NOL carryforward. For

additional information, see the Companys Annual Report on Form 10-K for the

year ended December 31, 2010, the Companys Quarterly Reports on Form 10-Q for

the quarters ended March 31, 2011, June 30, 2011, and September 30, 2011 and other

reports filed with and furnished to the Securities and Exchange Commission. |

3

3

DX Snapshot

Company Highlights

Internally managed REIT commenced operations in 1988

Significant insider ownership and experienced management team

Diversified investment strategy in residential and commercial mortgage assets

Large NOL carryfoward for unique total return opportunity

Market Highlights (as of 12/8/11 unless indicated)

NYSE Stock Ticker

DX

Shares Outstanding

40,382,435

Quarterly Dividend/Dividend Yield

$0.28/11.95%

Share Price

$9.12

Price to Book (based on BV per share as of 9/30/2011)

0.99x

Market Capitalization

$368.28 million |

4

4

Third Quarter 2011 Highlights

Reported

diluted

earnings

per

common

share

of

$0.32

Ex-Items

(1)

Reported book value per common share of $9.15

Generated a net interest spread of 2.43%

Declared a dividend of $0.27 per share, representing a 13.4% yield

on an annualized basis

(2)

Generated an annualized return on average equity of 13.7% based

on EPS Ex-Items

(1)

Overall leverage of 6.1x equity capital

(1)

EPS

Ex-Items,

or

Dynexs

earnings

per

share

excluding

certain

items,

excludes

from

GAAP

earnings per share the impact of litigation

settlement and related defense costs of $8.2 million (or $0.20 per diluted common

share), a loss of $2.0 million (or $0.05 per diluted common share) on

redemption of non-recourse collateralized financings, and $1.3 million (or $0.03 per diluted common share) in net accelerated

premium

amortization

due

to

an

increase

in

forecasted

prepayment

speeds during the third quarter of 2011. Reported Diluted EPS was $0.04.

(2) Based on the September 30, 2011 closing price of $8.06 per share. See the

Companys press release issued November 1, 2011 for further

discussion. |

5

5

Summary of Results

$0.28

$0.25

$0.27

$0.27

$0.27

$0.27

$0.34

$0.32

$0.31

$0.40

$0.33

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

Q3-2010

Q4-2010

Q1-2011

Q2-2011

Q3-2011

Q4-2011

Dividend per Share

EPS*

Dividends and Earnings Per Share*

$9.80

$9.64

$9.51

$9.59

$9.15

$8.00

$8.20

$8.40

$8.60

$8.80

$9.00

$9.20

$9.40

$9.60

$9.80

$10.00

Q3-2010

Q4-2010

Q1-2011

Q2-2011

Q3-2011

Book Value Per Share

2.98%

3.07%

2.68%

2.45%

2.43%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

Q3-2010

Q4-2010

Q1-2011

Q2-2011

Q3-2011

13.61%

16.17%

13.20%

14.10%

13.70%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

Q3-2010

Q4-2010

Q1-2011

Q2-2011

Q3-2011

Net Interest Spread

Return on Average Equity*

*As

presented

on

this

slide,

Q3-2011

earnings

per

share

and

return

on

average

equity

exclude

the

impact

of

certain

items.

Please see slide

4 for additional information.

*

*

*

* |

6

Portfolio Review

Our portfolio continues to perform well despite volatile markets.

Our portfolio is constructed to minimize prepayment risk, credit

risk, and extension risk.

Despite a high average portfolio dollar price, we have built in loan

level characteristics that work to offset trends to faster prepayment

speeds.

We have rotated further into securities in the CMBS sector with

explicit prepayment protection and higher expected ROEs.

Most of our CMBS exposure is to GSE multi-family programs, which

historically have demonstrated superior credit performance.

To minimize extension risk we have focused our portfolio on

securities that either reset or mature within 10 years. Our average

months to maturity or reset is 46 months as of September 30, 2011.

|

7

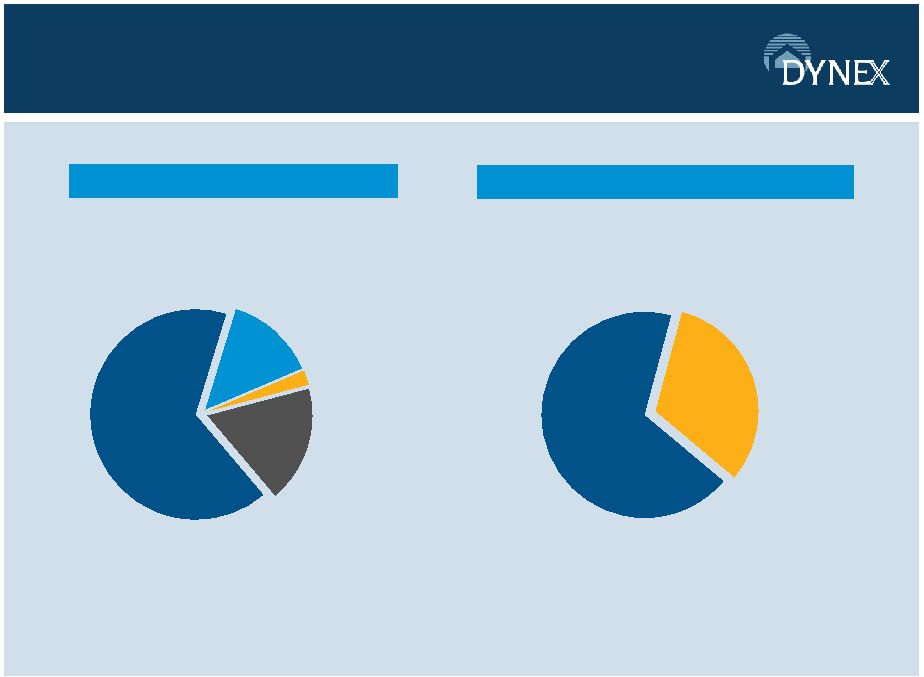

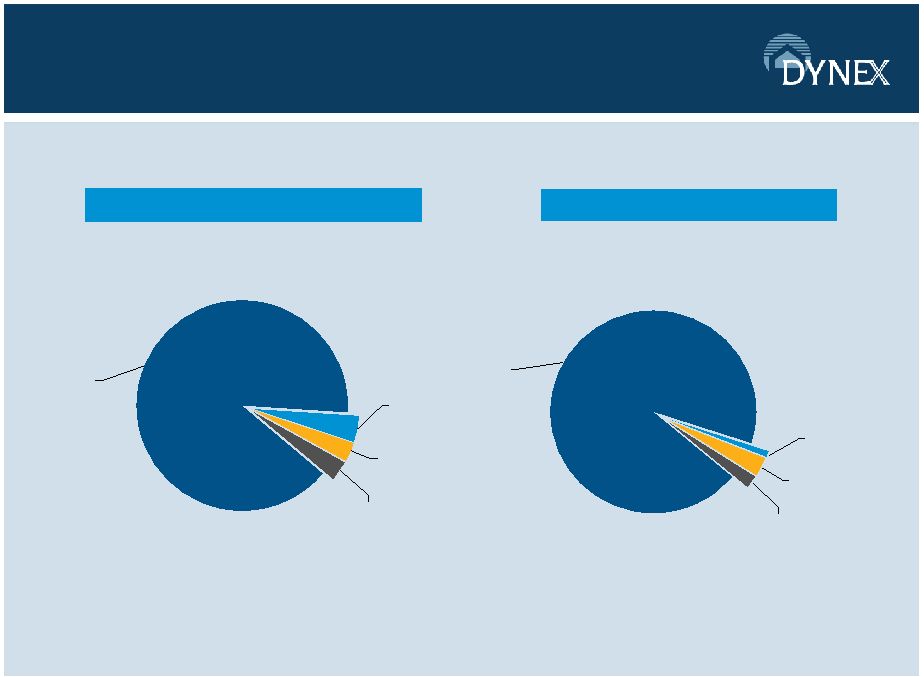

Portfolio Composition

(as of September 30, 2011)

Non-Agency

CMBS/Loans

18

%

Non-Agency

RMBS/Loans

2%

Agency RMBS

66%

Agency CMBS

14%

CMBS

32%

RMBS

68%

Agency/Non-Agency Breakdown

Residential/Commercial Breakdown |

8

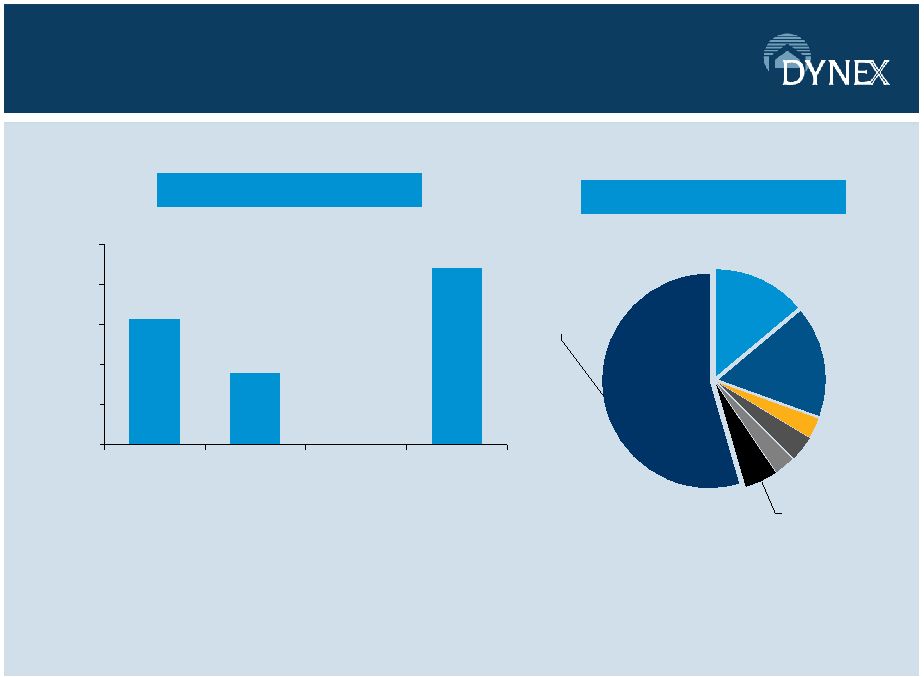

MBA Refi Index

Source: Bloomberg |

9

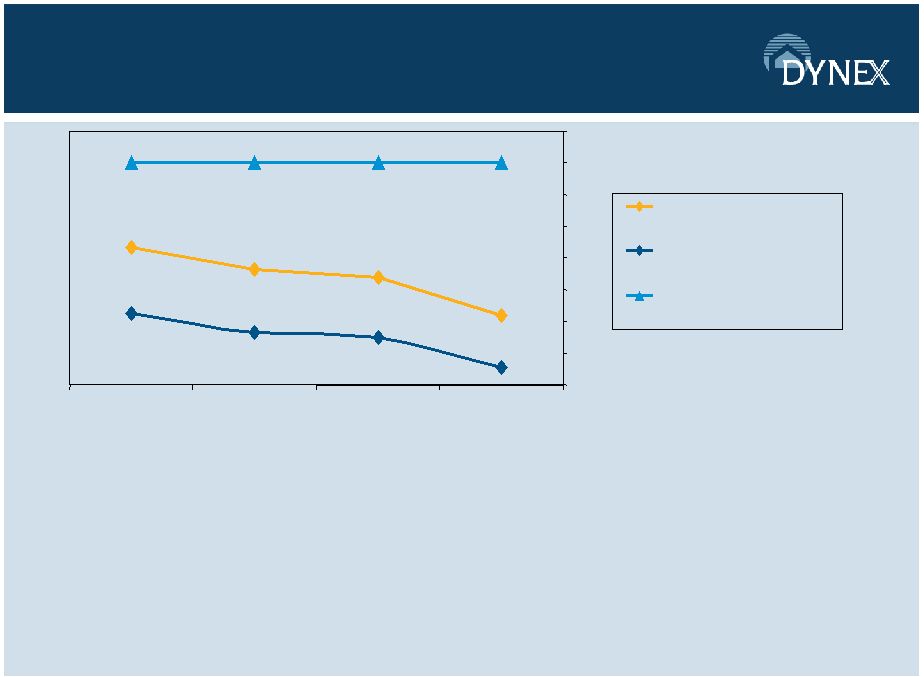

Prepayment Performance

(through September 30, 2011)

Table represents historical prepayment performance based on the investment portfolio as it

exists at September 30, 2011. Future modeled Agency MBS

represents the anticipated CPRs for the periods presented and reflects the

anticipated impact of HARP 2.0 and overall lower interest rates.

Consistent prepayment performance over the past year with minimum prepayment

spikes

Meticulously selected portfolio to minimize prepayment volatility

CPR

22.7%

21.3%

20.8%

18.4%

18.5%

17.3%

17.0%

15.1%

28%

28%

28%

28%

14%

16%

18%

20%

22%

24%

26%

28%

30%

1 mo

3 mo

6 mo

1 year

Agency MBS

Total portfolio

Future modeled Agency

MBS |

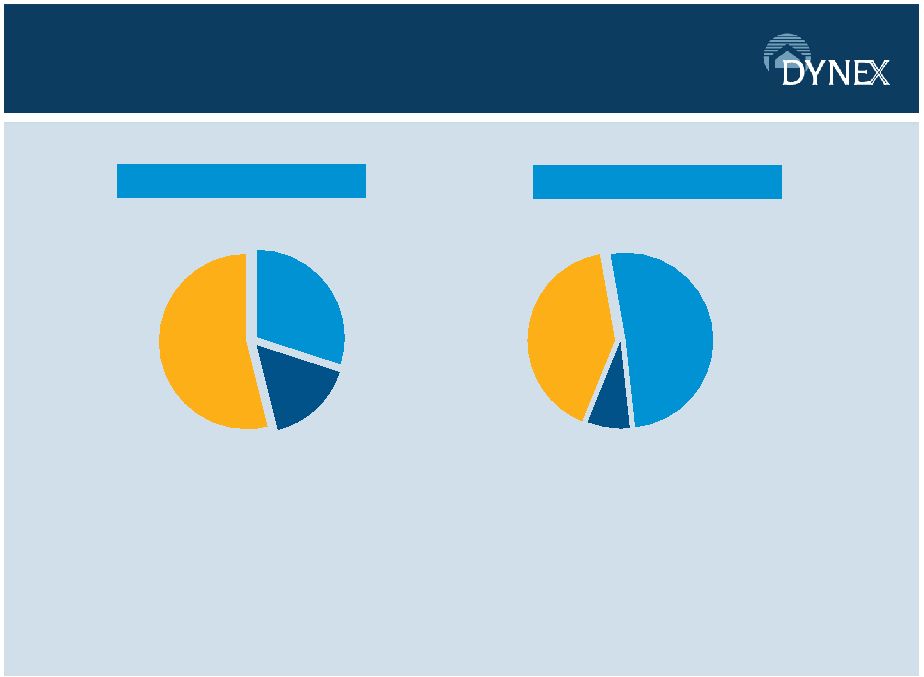

10

Prepayment Exposure

(as of September 30, 2011)

Post/near

reset*

16%

Selected

specified

pools

54%

Explicit

prepayment

protection

30%

Significant explicit prepayment protection

Meticulously selected portfolio to minimize prepayment exposure

* Less than 15 MTR

By Market Value

Post/near

reset*

8%

Selected

specified

pools

41%

Explicit

prepayment

protection

51%

By Dollar Premium |

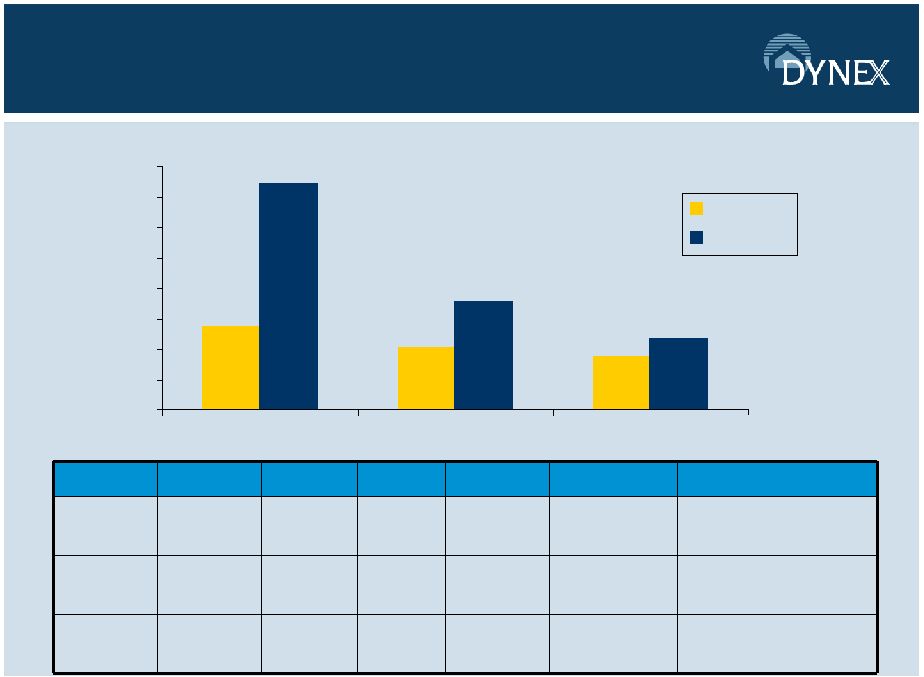

11

11

Key Prepayment Metrics

for Selected Specified Pools

$269.0

$292.0

$297.0

$225.0

$250.0

$275.0

$300.0

DX

All ARMs

5/1 ARMs

Average Loan Size

41.0%

58.0%

61.0%

25.0%

35.0%

45.0%

55.0%

65.0%

DX

All ARMs

5/1 ARMs

Third Party Originated

18.0%

15.0%

14.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

DX

All ARMs

5/1 ARMs

67.0%

48.0%

45.0%

0%

10%

20%

30%

40%

50%

60%

70%

DX

All ARMs

5/1 ARMs

Investor Property

Interest Only Loans

Source for Non-DX Metrics : JP Morgan

($ in thousands)

(as of September 30, 2011) |

12

Portfolio Ratings

A

3%

Below A

3%

AA

4%

AAA

90%

As of September 30, 2011

As of June 30, 2011

*Agency securities are considered AAA rated as of the dates presented

A

3%

Below A

2%

AA

1%

AAA

94% |

13

Non-Agency CMBS Vintage Portfolio

(as of September 30, 2011)

$0

$50,000

$100,000

$150,000

$200,000

$250,000

prior to 2000

2000-2005

2006-2008

2009 or

newer

($ in thousands)

By Property Type

By Year of Origination

Retail, 14%

Office, 17%

Industrial, 4%

Healthcare, 3%

Other, 5%

Multi-family, 55%

Hotel, 3% |

14

Extension Risk

(as of September 30, 2011)

Average

Life

(years)

Price

Coupon

WAC

Speed

Average Life

Average Life Extension

FN 30yr

$103-10

4.00%

4.43%

15 CPR

2 CPR

5.41 years

14.78 years

~9 years

FNCI 15yr

$103-10

3.50%

3.80%

15 CPR

2 CPR

4.01 years

6.98 years

~3 years

5/1 ARM

$103-2

2.75%

3.16%

15 CPB

2 CPB

3.35 years

4.57 years

~1 year

0

2

4

6

8

10

12

14

16

FN 30 year

FNCI 15 year

5/1 ARM

15 CPR/CPB

2 CPR/CPB |

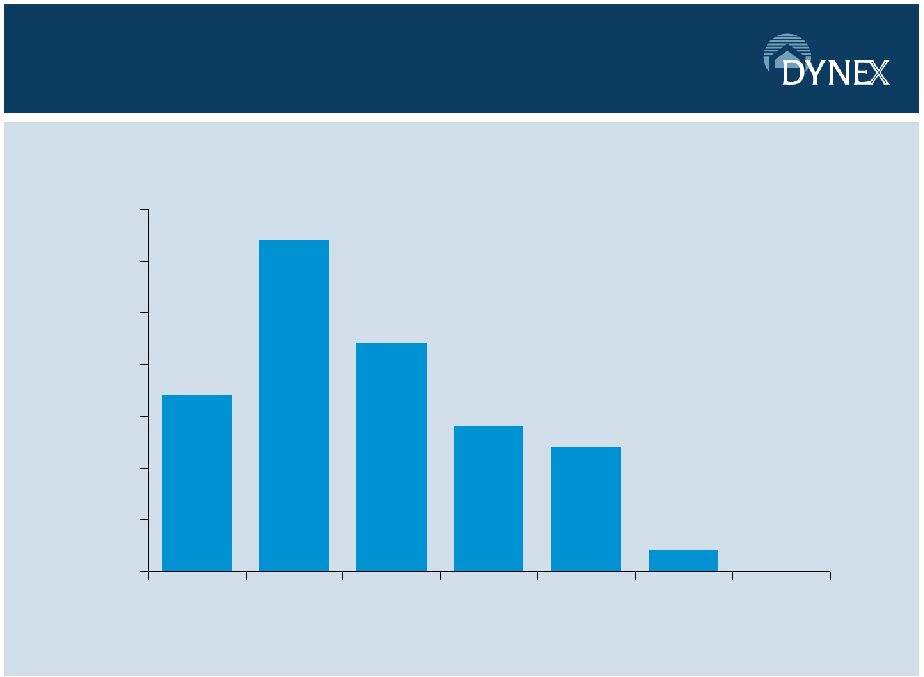

15

Portfolio Maturity/Reset Distribution

(as of September 30, 2011)

0%

2%

12%

14%

17%

22%

32%

0%

5%

10%

15%

20%

25%

30%

35%

<15

16-40

41-60

61-84

85-120

120-125

125-360

Months to Maturity or Reset |

16

Potential Return Profile for Current Focus

Investments

(as

of

October

31,

2011)

Investment

Range of

Prices

Range of

yields

Range of net

spread to

funding

Range of

ROEs

Agency RMBS

103-108

2.3%-

2.8%

1.8%-2.3%

16%-23%

Agency CMBS

103-111

3.1%-3.5%

1.3%-2.0%

15%-20%

Non-Agency A

AAA

RMBS

85-103

3.5%-7.0%

2.6%-4.0%

14%-24%

Non-Agency A-

AAA

CMBS

85-107

4.5%-6.4%

2.2%-4.1%

15%-23%

The above portfolio is for illustrative purposes only, does not represent actual or expected

performance and should not be relied upon for any investment decision. The range of

returns on equity is based on certain assumptions, including assumptions relating to asset allocation

percentages and spreads where mortgage assets can be acquired versus a current cost of funds

to finance acquisitions of those assets. Rates used represent a range of asset yields

and funding costs based on data available as of the date referenced above. Any change in the assumed

yields,

funding

costs

or

assumed

leverage

could

materially

alter

the companys returns. There can be no assurance that asset yields or funding

costs will remain at current levels. For a discussion of risks that may affect our ability to

implement strategy and other factors which may affect

our

potential

returns,

please

see

the

section

entitled

Risk

Factors

in our Annual Report on Form 10-K for the year ended December 31,

2010 and our Quarterly Reports on Form 10-Q for the quarters ended June 30, 2011 and

September 30, 2011. |

17

Portfolio Summary

Our portfolio has performed well since 2008 and the

earnings power today remains relatively intact.

Prepayment risk is mitigated by superior portfolio

construction and HARP 2.0 should have less impact on

Hybrid ARMs.

Credit risk is mitigated by highly-rated securities, superior

loan origination years and concentration in multifamily

collateral.

Extension risk is mitigated by the short-duration investment

portfolio with 71% of the investments maturing or resetting

within five years (as of September 30, 2011).

There continues to be attractive investment opportunities

to deploy capital despite the volatile financial markets. |

18

Recourse Financing

(as of September 30, 2011)

2.63%

$42,000

>60

1.58%

$1,022,000

Total

1.62%

$805,000

24-60

1.14%

$175,000

0-24

WAVG

Rate

Total

Notional

Balance

Maturity

(mos.)

SWAPS

0.31%

446,811

>90

$2,053,686

Total

0.49%

429,177

30-90

0.45%

$1,177,698

0-30

WAVG

Rate

Financing

Balance

Original

Maturity

(Days)

Repurchase Agreements

0.43%

1.21%

0.30%

WAVG Rate

Financing

Balance

$2,053,686

285,237

Non-

Agency

$1,768,449

Agency

WAVG Maturity 36 months

($ in thousands) |

19

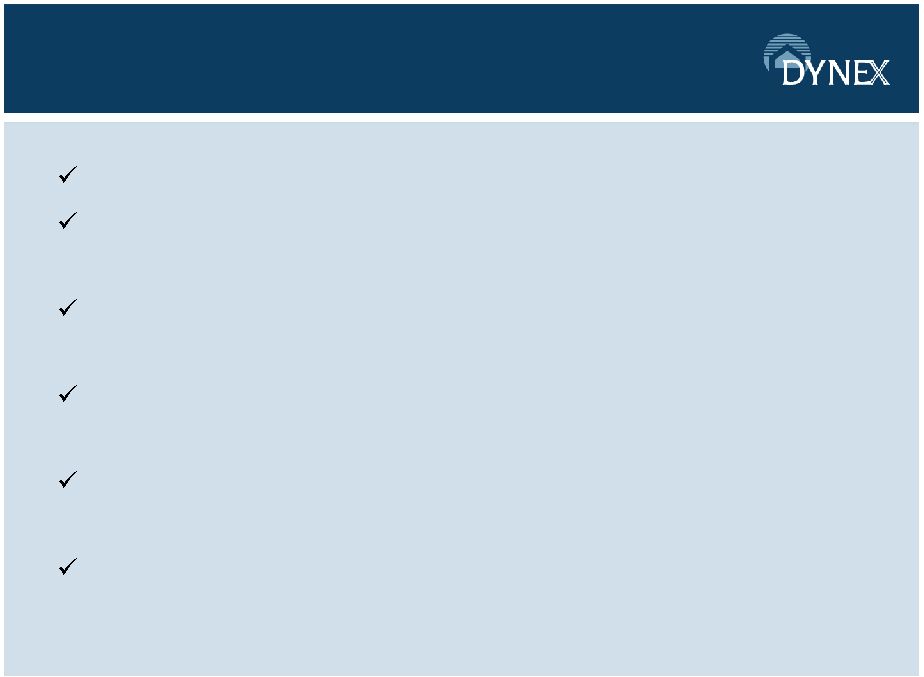

19

Why Dynex

Excellent long term performance record

Solid balance sheet positioned to perform through multiple market

environments

Experienced management with a track record of disciplined capital

deployment through multiple economic cycles

Alignment of interests with shareholders due to owner-operator

structure

Complimentary investment opportunities exist with attractive return

profiles consistent with our investment philosophy

Opportunistic capital raises have increased shareholder value |

20

APPENDIX |

21

21

Management Team

Thomas

B.

Akin

Chairman

and

Chief

Executive

Officer

33 years of experience in the industry and 8 years at Dynex

Chairman since 2003 and CEO since 2008

Managing Member of Talkot Capital, LLC

16 years at Merrill Lynch and Salomon Brothers

Byron

L.

Boston

Chief

Investment

Officer

28 years of experience in the industry with 4 years as CIO at Dynex

13 years managing levered multi-product portfolios at Freddie Mac and Sunset Financial

Resources

11 years trading MBS on Wall Street

3 years Senior Corporate Lending Officer at Chemical Bank

Stephen

J.

Benedetti

Chief

Financial

Officer

and

Chief

Operating

Officer

22 years of experience in the industry

Employed at Dynex for 17 years in various treasury, risk management and financial reporting

roles

Managed

Dynex

from

2002

2007

Began career at Deloitte & Touche

Portfolio

Management

Team

5 member team with a collective 65 years of industry experience with broad and deep skill sets

in both agency and non-agency investment strategies

Experienced team of professionals with a combined 80 years of experience

managing mortgage REITs and mortgage portfolios |

22

Capital Allocation

(as of September 30, 2011)

(1) Associated financing for investments includes repurchase agreements, securitization

financing issued to third parties and TALF financing (the latter two of which are

presented on the Companys balance sheet as non-recourse collateralized financing). Associated financing for hedging instruments represents the fair value

of the interest rate swap agreements in a liability position.

($ in millions)

Asset Carrying

Basis

Associated

Financing

(1)

/

Liability

Carrying Basis

Allocated

Shareholders'

Equity

Leverage

Target

Notes

$1,337.3 mm in Hybrid Agency ARMs

-

Weighted average months-to-reset of 40 months

$358.7 mm in Agency ARMs

-

Weighted average months-to-reset of 8 months

Agency CMBS

355.9

(251.3)

104.6

8x

Fixed rate agency CMBS

Voluntary prepayment protected

3Q 2011 weighted average annualized yield of 6.58%

~33% AAA

and AA

rated

3Q 2011 weighted average annualized yield of 6.03%

~74% AAA

and AA

rated

Loans pledged to support repayment of securitization

bonds issued by the Company

Originated in the 1990s

Unsecuritized single family and commercial mortgage

loans

Derivative

Instruments

-

(28.8)

(28.8)

-

Consists of interest rate swaps

Total

$2,595.4

($2,240.3)

$355.1

5

7x

6.1x actual leverage

1.0

(84.9)

33.8

2

3x

(322.8)

67.9

3

5x

$173.7

7

9x

2.9

4

5x

Agency RMBS

Non-Agency

RMBS

($1,542.5)

(10.0)

$1,716.2

12.9

118.7

1.0

Non-Agency

CMBS

Securitized

mortgage loans

Other investments

390.7 |

23

23

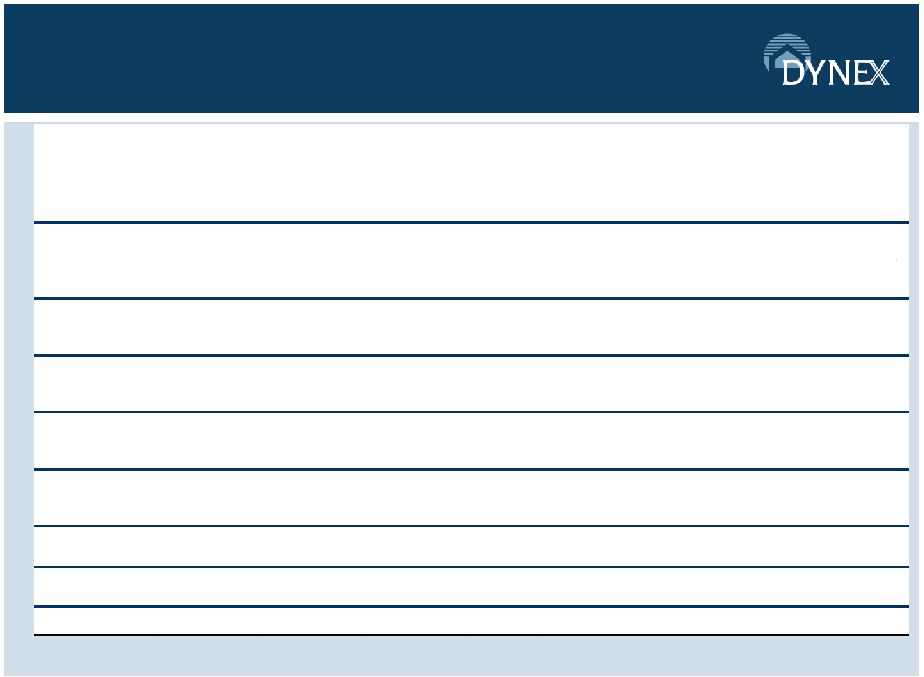

Selected Financial Highlights

(as of and for the quarter ended)

* Diluted EPS Ex-Items was $0.32. EPS Ex-Items, or Dynexs earnings per share

excluding certain items, excludes from GAAP earnings per share the impact of litigation settlement

and related defense costs of $8.2 million (or $0.20 per diluted common share), a loss of $2.0 million

(or $0.05 per diluted common share) on redemption of non-recourse collateralized

financings, and $1.3 million (or $0.03 per diluted common share) in net accelerated premium

amortization due to an increase in forecasted prepayment speeds during the third quarter

Financial Highlights:

($000 except per share amounts)

Sept 30, 2011

Jun 30, 2011

Mar 31, 2011

Dec 31, 2010

Sept 30, 2010

Total Investments

2,595,574

$

2,591,097

$

2,279,610

$

1,614,126

$

$ 1,064,546

Total Assets

2,633,686

2,656,703

2,359,816

1,649,584

1,091,835

Total Liabilities

2,264,152

2,269,843

1,976,323

1,357,227

866,361

Total Equity

369,534

386,860

383,493

292,357

225,474

Interest Income

21,143

21,065

17,465

11,734

Interest Expense

6,583

6,032

4,734

3,385

3,333

Net Interest Income

14,560

15,033

12,731

10,896

8,401

General and Administrative Expenses

2,335

2,255

2,118

2,911

1,971

Net income

1,532

$

13,594

$

10,280

$

9,646

$

7,022

Diluted EPS

$

0.04* 0.34

$

0.31

$

0.40

$

0.33

$

Dividends declared per common share

0.27

0.27

0.27

0.27

0.25

Book Value per share

9.15

9.59

9.51

9.64

9.80

14,281

$

of 2011. See the Companys press release issued November 1, 2011 for further

discussion. |