INVESTOR PRESENTATION MATERIALS

Published on August 24, 2012

The

MoneyShow San Francisco Finding Yield in a

Zero Rate World

August 24, 2012

Exhibit 99.1 |

2

2

Safe Harbor Statement

NOTE:

This presentation contains certain statements that are not historical facts and that constitute forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Statements in this presentation addressing expectations,

assumptions, beliefs, projections, future plans, strategies, and events, developments that we

expect or anticipate will occur in the future, and future operating results or financial condition are forward-looking statements.

Forward-looking statements in this presentation may include, but are not limited to, statements

about projected future investment strategies and leverage ratios, future financial performance,

the projected impact of NOL carryforwards, future dividends paid to shareholders, and future investment opportunities and capital

raising activities. The words will, believe, expect,

forecast, anticipate, intend, estimate, assume,

project, plan, continue, and similar expressions also identify forward-looking

statements. These forward-looking statements reflect our current beliefs, assumptions and expectations based on information

currently available to us, and are applicable only as of the date of this presentation.

Forward-looking statements are inherently subject to risks, uncertainties, and other

factors, some of which cannot be predicted or quantified and any of which could cause the Companys actual results and timing of certain events to differ

materially from those projected in or contemplated by these forward-looking statements. Not all of

these risks, uncertainties and other factors are known to us. New risks and uncertainties arise

over time, and it is not possible to predict those risks or uncertainties or how they may affect us. The projections, assumptions,

expectations or beliefs upon which the forward-looking statements are based can also change as a

result of these risks and uncertainties or other factors. If such a risk, uncertainty, or other

factor materializes in future periods, our business, financial condition, liquidity and results of operations may differ materially from those

expressed or implied in our forward-looking statements.

While it is not possible to identify all factors, some of the factors that may cause actual results to

differ from historical results or from any results expressed or implied by our

forward-looking statements, or that may cause our projections, assumptions, expectations or beliefs to change, include the following: the risks and

uncertainties referenced in our Annual Report on Form 10-K for the year ended December 31, 2011 and subsequent filings with the Securities and Exchange

Commission, particularly those set forth under the caption

Risk Factors; our ability to find suitable reinvestment opportunities; changes in economic conditions;

changes in interest rates and interest rate spreads, including the repricing of interest-earnings

assets and interest-bearing liabilities; our investment portfolio performance particularly

as it relates to cash flow, prepayment rates and credit performance; the cost and availability of financing; the cost and availability of new

equity capital; changes in our use of leverage; the quality of performance of third-party service

providers of our loans and loans underlying our securities; the level of defaults by borrowers

on loans we have securitized; changes in our industry; increased competition; changes in government regulations affecting our business;

regulatory actions, if any, taken in connection with an SEC review of certain sections of the

Investment Company Act of 1940; government initiatives to support the U.S financial system and

U.S. housing and real estate markets; financial condition and future operations of the GSEs; GSE reform or other government policies

and actions; an ownership shift under Section 382 of the Internal Revenue Code that impacts the use of

our tax NOL carry forward; and our continued eligibility for inclusion in Russell Indexes and

the materiality of the income taxes which may be due to the Companys ownership of securities that generate excess inclusion

income.

|

Ways

Investors Can Find Yield: Indicated yields based on publicly available

information as of August 22, 2012. Actual yields may vary

substantially from the amounts indicated above 3

MLPs

~ 5%

Annuities

~ 4.5%

S&P 500

Equities

~ 2.1%

Treasury

Bonds

2 Yr ~.29%

MREITS

~ 10%+ |

4

Our Guiding Principles

Our Mission

Our Core Values

Generate dividends for shareholders

Manage leverage conservatively

Remain owner-operators

Maintain a culture of integrity and employ the highest ethical

standards

Provide a strong risk management culture

Focus on long-term shareholder value while preserving capital

Manage

a

successful

public

mortgage

REIT

with

a

focus

on

capital

preservation

and

providing

risk-adjusted

returns

reflective

of

a

diversified,

leveraged

fixed

income

portfolio. |

5

DX Snapshot

Market Highlights: (as of 8/20/12)

Common

Preferred

NYSE Stock Ticker:

DX

DXPrA

Shares Outstanding:

54,367,218

2,300,000

Dividends

Q2: $0.29

Annually: $2.125

Share Price:

$10.42

$25.58

Price to Book:

1.08x

Liquidation

Preference: $25

Market Capitalization:

$566.5 million

-

Large NOL

carryforward for

unique total

return

opportunity

Diversified

investment

strategy

investing in

residential and

commercial

mortgage assets

Significant

inside

ownership and

experienced

management

team

Internally

managed REIT

commenced

operations in

1988 |

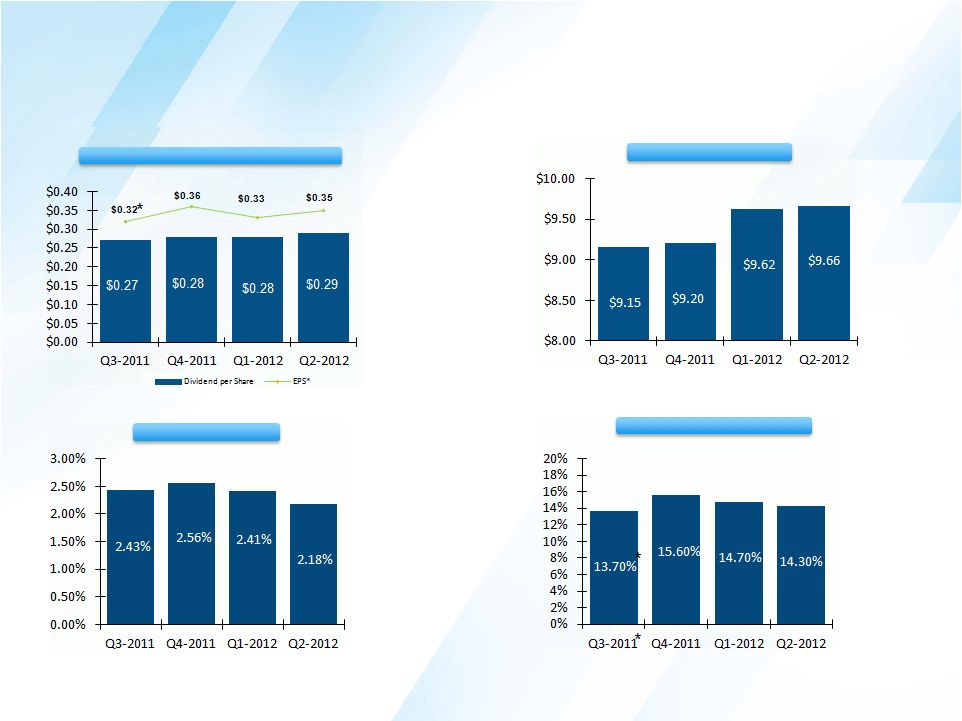

Summary of

Results Dividends and Earnings Per Share*

Book Value Per Share

Net Interest Spread

Return on Average Equity*

*As

presented

on

this

slide,

Q3-2011

earnings

per

share

and

return

on

average

equity

exclude

the

impact

of

certain

items

(EPS

Ex-Items).

EPS

Ex-Items

for

Q3-2011

excludes

from

GAAP

earnings

per

share

the

impact

of

litigation

settlement

and

related

defense

costs

of

$8.2

million

(or

$0.20

per

diluted

common

share),

a

loss

of

$2.0

million

(or

$0.05

per

diluted

common

share)

on

redemption

of

non-recourse

collateralized

financings,

and

$1.3

million

(or

$0.03

per

diluted

common

share)

in

net

accelerated

premium

amortization

due

to

an

increase

in

forecasted

prepayment

speeds

during

the

third

quarter

of

2011.

For

Q3-2011,

reported

diluted

EPS

was

$0.04

and

reported

annualized

ROAE

was

1.6%. |

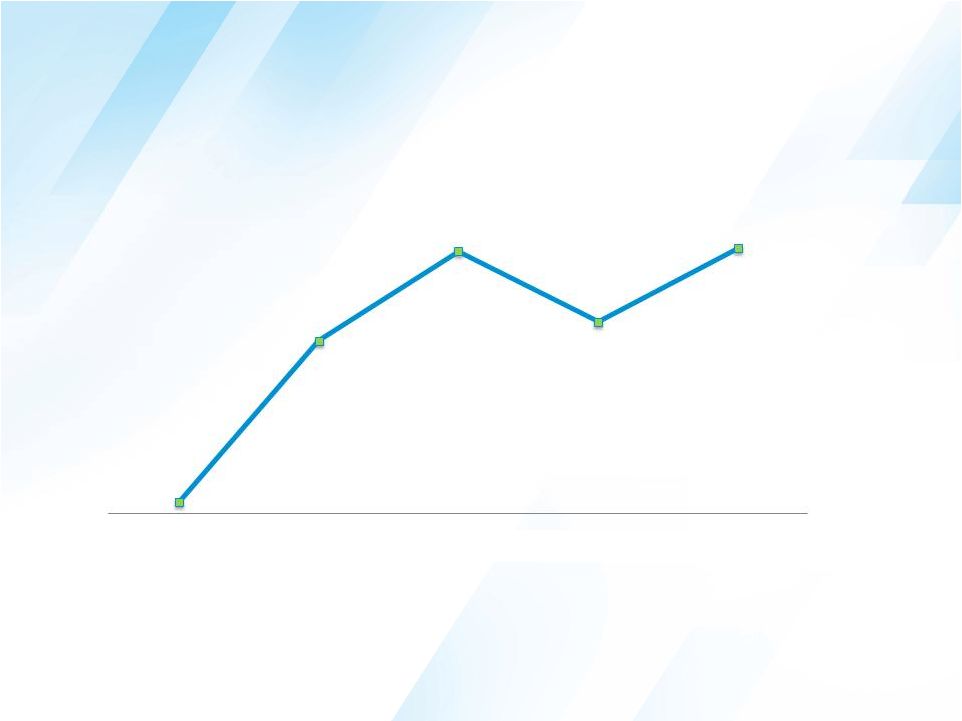

Book Value

Growth Since 2008 $8.07

$9.08

$9.64

$9.20

$9.66

2008

2009

2010

2011

6/30/2012

7 |

Trading

Comparables Yields

Portfolio Leverage

8

Source: J.P. Morgan and Company data

For DX, indicated yield is ROE for 2Q 2012 and for all others, indicated yield is

dividend yield as of 8/17/2012 |

9

Our Portfolio Strategy

OUR GOAL IS TO LIMIT CREDIT, INTEREST RATE,

PREPAYMENT, AND EXTENSION RISK IN OUR INVESTMENT

PORTFOLIO BY CONSTRUCTING A PORTFOLIO WITH:

Agency and Non-Agency Securities

Short Duration Assets

High Credit Quality

Prepayment Protection

Low Leverage |

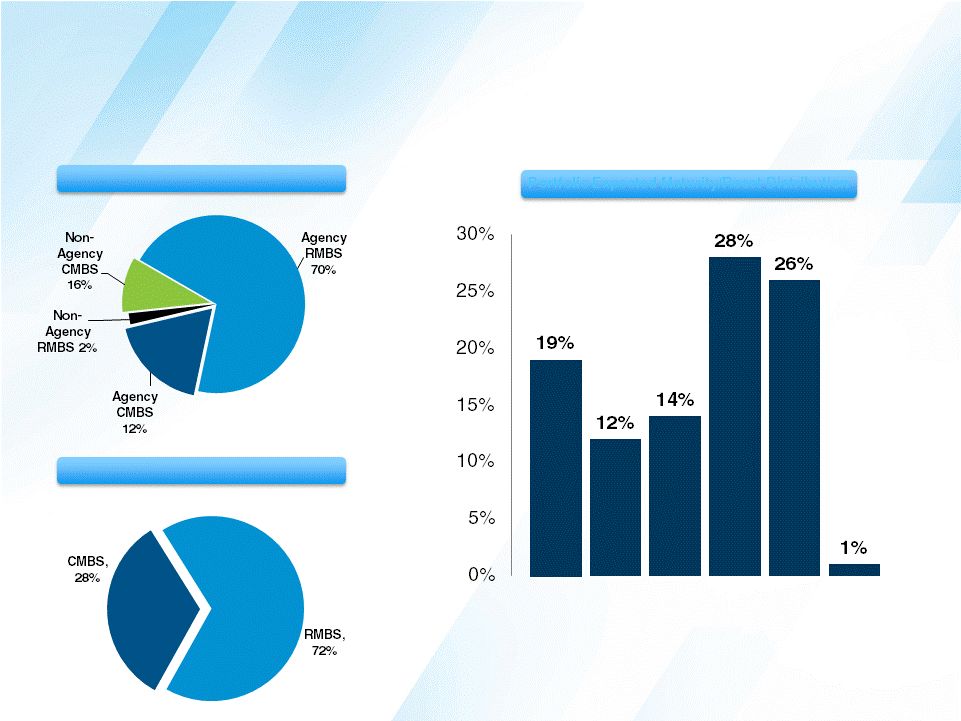

10

DX Investment Portfolio

(as of June 30, 2012)

<15 16-40

41-60 61-84 85-120 120-125

Months to Maturity/Reset

Agency/Non-Agency

Portfolio Expected Maturity/Reset Distribution

Residential/Commercial |

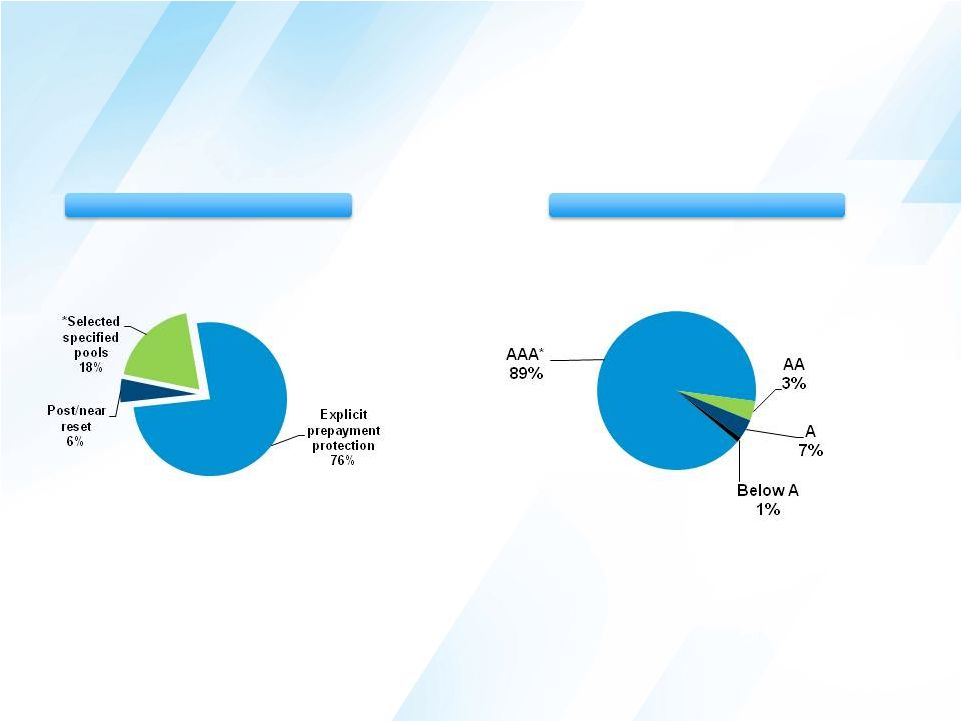

DX Portfolio

Detail (as of June 30, 2012)

11

*Agency MBS are considered AAA rated as of the date presented

Dollar Prepayment Premium Exposure

Credit Quality |

CMBS

Portfolio (as of June 30, 2012)

12

Asset Type

By year of origination

$

in millions

$

in millions

*Agency CMBS are considered AAA-rated as of the date presented

Credit Quality

Non-Agency Vintage

Collateral |

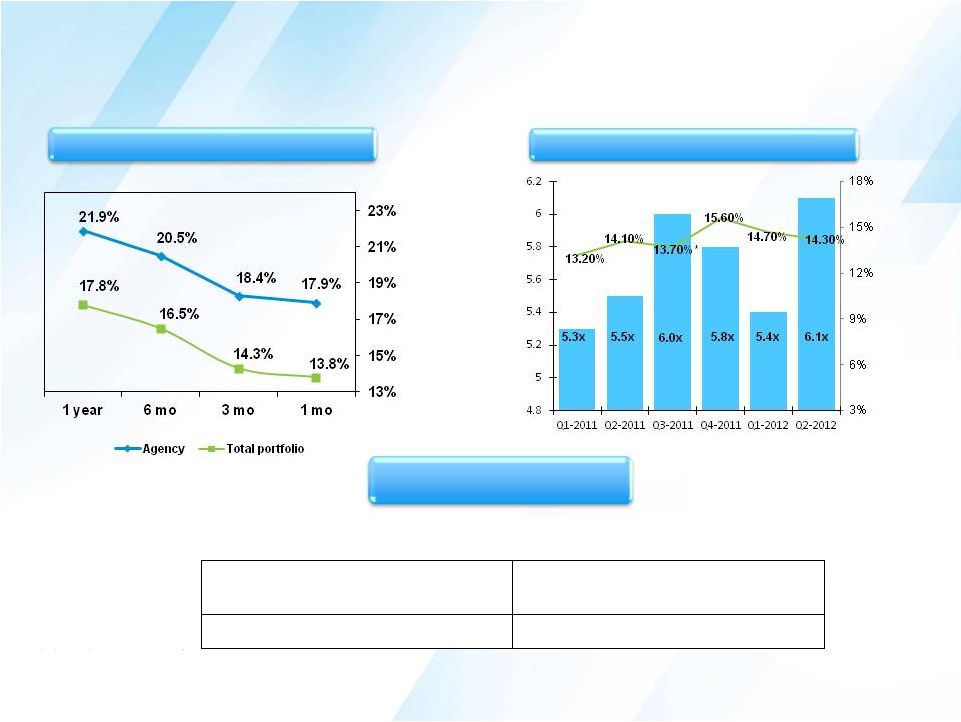

Portfolio

Performance *As

presented

on

this

slide,

Q3-2011

return

on

average

equity

is

calculated

based

on

a

measure

that

excludes

the

impact

of

certain

items

on

earnings

per

share

(EPS

Ex-Items).

EPS

Ex-Items

for

Q3-2011

was

$0.32 and excludes from GAAP earnings per share the impact of litigation settlement

and related defense costs of $8.2 million (or $0.20 per diluted common share), a loss of $2.0 million (or $0.05 per diluted

common

share)

on

redemption

of

non-recourse

collateralized

financings,

and

$1.3

million

(or

$0.03

per

diluted

common

share)

in

net

accelerated

premium

amortization

due

to

an

increase

in

forecasted

prepayment

speeds during the third quarter of 2011. For Q3-2011, reported diluted EPS was

$0.04 and reported annualized ROAE was 1.6%. (as of June 30,

2012) Net Interest Spread

(quarter ended)

Prepayment Performance

Leverage and ROE

June 30, 2012

March 31, 2012

Agency

Non-Agency

Portfolio

Agency

Non-Agency

Portfolio

2.75%

6.05%

3.29%

2.98%

6.49%

3.58%

(0.88%)

(2.55%)

(1.11%)

(0.91%)

(2.52%)

(1.17%)

1.87%

3.50%

2.18%

2.07%

3.97%

2.41%

Investment Yield

Cost of funds

Net interest spread |

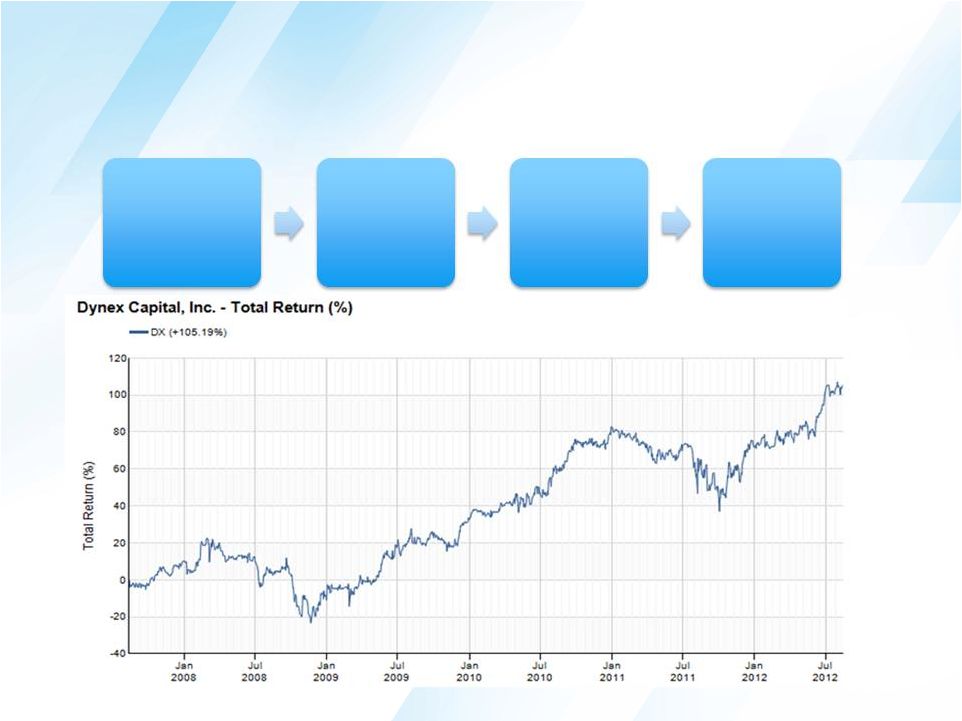

14

Dynex Value Proposition

Source: SNL

+105.19%

Internally

Managed and

Publicly Traded

Since 1988

Diversified

Investment

Strategy

Large Tax

NOL

Significant

Insider

Ownership |

15

APPENDIX |

16

Capital Allocation (as of June 30, 2012)

(1) At June 30, 2012, associated financing for investments includes repurchase

agreements, and securitization financing issued to third parties (the latter of which are presented on the Companys balance

sheet as non-recourse

collateralized financing). Associated financing for hedging instruments represents the fair value of the interest rate swap agreements in a liability position.

($ in millions)

Asset Carrying

Basis

Associated

Financing

(1)

/

Liability

Carrying Basis

Allocated

Shareholders'

Equity

Leverage

Target

Notes

$1,715.0 in Hybrid Agency ARMs

- Weighted average months-to-reset of 65 months

$552.2 in Agency ARMs

- Weighted average months-to-reset of 8 months

Agency CMBS

328.8

(225.0)

103.7

8x

Weighted average months-to-maturity of 102

Voluntary prepayment protected

Agency CMBS IO

299.9

(243.7)

56.2

3 - 4x

Weighted average months-to-maturity of 100 months

Non-Agency RMBS

18.1

(14.6)

3.5

4 - 5x

2Q 2012 weighted average annualized yield of 5.60%

~43% AAA and AA rated

Non-Agency CMBS

2Q 2012 weighted average annualized yield of 5.81%

~47% AAA and AA rated

Non-Agency CMBS IO

66.0

(51.1)

14.9

3 - 4x

2Q 2012 weighted average annualized yield of 7.64%

100% "AAA" and "AA" rated

Loans pledged to support repayment of securitization

bonds issued by the Company

Originated in the 1990s

Unsecuritized single family and commercial mortgage

loans

Derivative Instruments

0.0

(39.3)

(39.3)

-

Consists of interest rate swaps

Cash and cash equivalents

53.8

0.0

53.8

-

Other assets/other liabilities

47.3

(20.9)

26.4

-

Total

$3,729.2

($3,204.1)

$525.1

6-7x

0.0

0.9

-

(57.7)

31.5

3 - 4x

($2,162.5)

$2,350.4

(389.3)

85.6

3 - 4x

$187.9

8 - 9x

89.2

0.9

Securitized mortgage loans

Other investments

474.9

Agency RMBS |

17

17

Selected Financial Highlights

(as of and for the quarter ended)

Financial Highlights:

($000 except per share amounts)

Jun 30, 2012

Mar 31, 2012

Dec 31, 2011

Sept 30, 2011

Jun 30, 2011

Total Investments

3,628,163

$

3,276,170

$

2,500,976

$

2,595,574

$

2,591,097

$

Total Assets

3,729,197

3,349,056

2,582,193

2,633,686

2,656,703

Total Liabilities

3,204,124

2,826,159

2,210,844

2,264,152

2,269,843

Total Equity

525,073

522,897

371,349

369,534

386,860

Interest Income

27,125

26,272

23,704

21,143

21,065

Interest Expense

8,117

7,125

6,732

6,583

6,032

Net Interest Income

19,008

19,147

16,972

14,560

15,033

General and Administrative Expenses

3,024

3,121

3,249

2,335

2,255

Net Income

18,847

$

16,476

$

14,406

$

1,532

$

13,594

$

Diluted EPS

0.35

$

0.33

$

0.36

$

0.04

$

0.34

$

Dividends Declared per Common Share

0.29

0.28

0.28

0.27

0.27

Book Value per Share

9.66

9.62

9.20

9.15

9.59

* Diluted

EPS

Ex-Items

was

$0.32.

EPS

Ex-Items,

or

Dynexs

earnings

per

share

excluding

certain

items,

excludes

from

GAAP

earnings

per

share

the

impact

of

litigation

settlement

and

related

defense

costs

of

$8.2

million

(or

$0.20

per

diluted

common

share),

a

loss

of

$2.0

million

(or

$0.05

per

diluted

common

share)

on

redemption

of

non-recourse

collateralized

financings,

and

$1.3

million

(or

$0.03

per

diluted

common share) in net accelerated premium amortization due to an increase in

forecasted prepayment speeds during the third quarter of 2011. See the Companys press release issued November 1, 2011 for

further discussion.

* |